In a nutshell a health savings account lets you contribute money on a pre-tax basis and your money gets the chance to grow tax-free until you use it for qualified healthcare expenses. HSAs can be used for out-of-pocket medical dental and vision.

Health Savings Account HSA A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

Health savings account plan. You can open an HSA with any HSA eligible health plan and use those tax deductible funds to pay for eligible medical costs. You not your employer or insurance company own and control the money in your HSA. An account with Fidelity offers.

You must be an eligible individual to qualify for an HSA. The account pays interest of 003 APY on balances up to 2500 rising to 007 for accounts over 7500. If you have at least 1000 in the account you can also choose to invest in mutual funds.

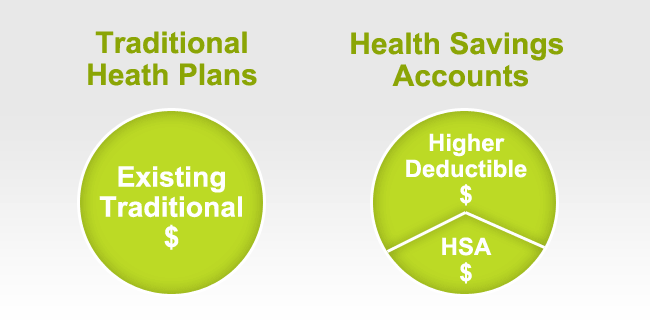

Once an HSA account holder turns 65 distributions not. The key things to know about HSAs are. This savings plan acts as an alternative to a traditional Insurance health plan.

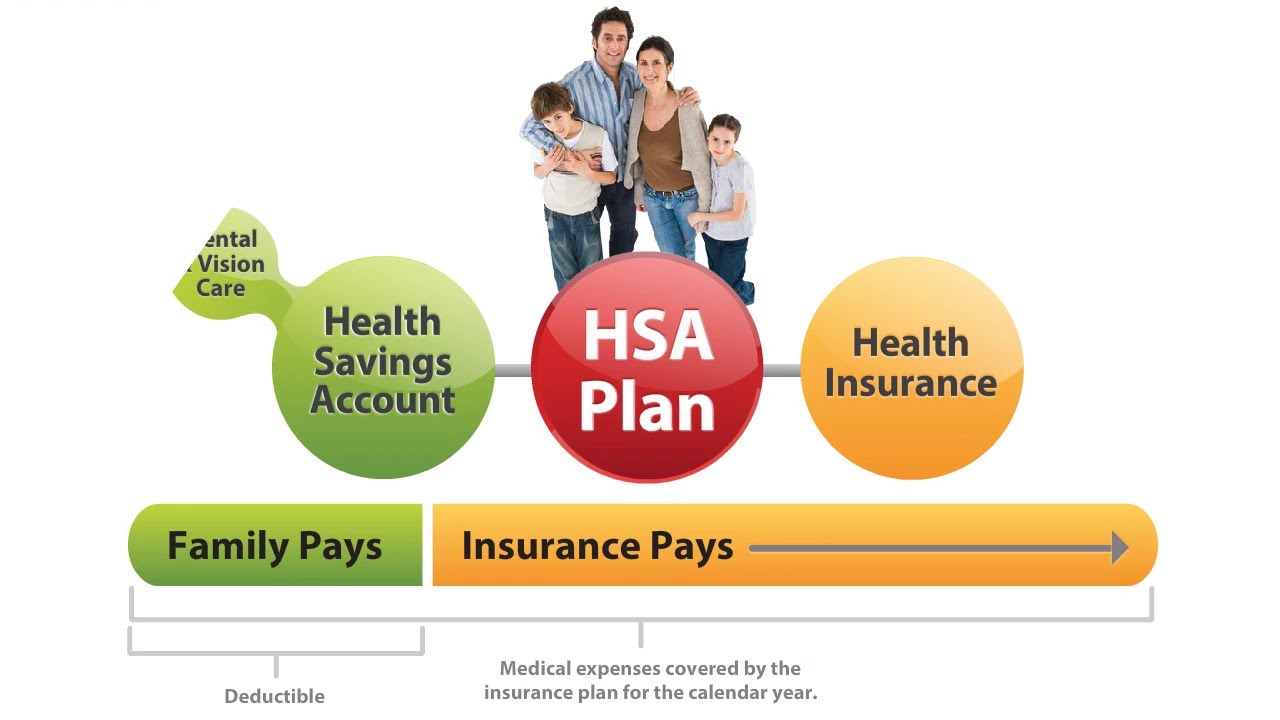

Health savings accounts are intended to help people with high-deductible health insurance plans pay for medical expenses. Health Savings Accounts HSAs A Health Savings Account HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur. You must be covered by a high-deductible health plan to open an HSA.

HSA helps you pay for covered expenses now and save for medical expenses you may have in the future especially in your retirement years. Access health coverage in the form of an Annual Deductible Health Plan1. The lowdown on HSAs.

The Fidelity HSA is a brokerage account that gives you flexibility with your money. One benefit of an HSA. These plans can be paired with employer-provided or individual health plans.

HSAs cant be used to pay health insurance premiums. A health savings account HSA is a tax-advantaged financial tool where you can make tax-free contributions directly from your paycheck to either pay for healthcare-related expenses or. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses.

A Health Savings Account HSA can help people with high-deductible health insurance plans cover their out-of-pocket costs. Contributions to HSAs generally arent subject to federal income tax and. The HSA combines the flexibility of a medical insurance plan with the cost effectiveness of a tax-advantaged savings account.

HSA stands for health savings account. You must be enrolled in a high deductible health plan HDHP. A Health Savings Account HSA is a tax-advantaged medical savings account you can contribute to and draw money from for certain medical expenses tax-free.

Its separate from the type of network options of a PPO HMO etc. HSAs help your employees play a larger role in their own health care by letting them. Health savings account HSA contribution limits for 2021 are going up 50 for self-only coverage and 100 for family coverage the IRS announced May.

HSAs work as a retirement savings plan because money can be withdrawn penalty-free for any purpose not just medical expenses after age 65. Health savings plan HSA offers you health insurance cover as well as premium savings to pay for your future medical expenses. With Bank of America you can open a health savings account with no minimum initial deposit but they do charge a monthly fee of 250.

Just as the name implies a health savings account HSA is a financial account designed to help you save for qualified health care expenses. Archer medical savings plans MSA plans were a predecessor to the current HSAs. Broad investing options fractional shares and cash options.

A health savings account or HSA is an account you use to pay for qualified medical pharmacy dental and vision expenses and save on taxes. No account minimums or fees 3. No permission or authorization from the IRS is necessary to establish an HSA.

Fidelity Health Savings Funds designed to help investors save for health care expenses. Holistic wealth and retirement planning. Health savings accounts HSAs are available to individuals and families with a high-deductible health plan HDHP.

By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs. And typically is cheaper than non-HSA eligible plans. You own your HSA and the money in it.

Not just anyone can open an HSA.

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Hsa 2020 Limits Millennium Medical Solutions Inc

Hsa 2020 Limits Millennium Medical Solutions Inc

So What Exactly Is An Hsa Health Savings Account Health Savings Account Accounting Good To Know

So What Exactly Is An Hsa Health Savings Account Health Savings Account Accounting Good To Know

Health Savings Plan Accounts Paris Insurance Services

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

How Does An Health Savings Account Hsa Work Youtube

How Does An Health Savings Account Hsa Work Youtube

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

Health Savings Plan Accounts Paris Insurance Services

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

5 Things To Know About Health Savings Accounts Thinkhealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.