If you have questions about the information on your IRS Form 1095-B or about lost or. If your state does you may need to report coverage information on your state tax return.

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png) Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Accordingly individual tax payors no longer have to report or certify on their federal returns whether they had health insurance during the tax year and do not need this form.

Federal form 1095. This form is used to verify on your tax return that you and your dependents have at. It may be available in your HealthCaregov account as soon as mid-January. You can download or print current or past-year PDFs of Form 1095-B directly from TaxFormFinder.

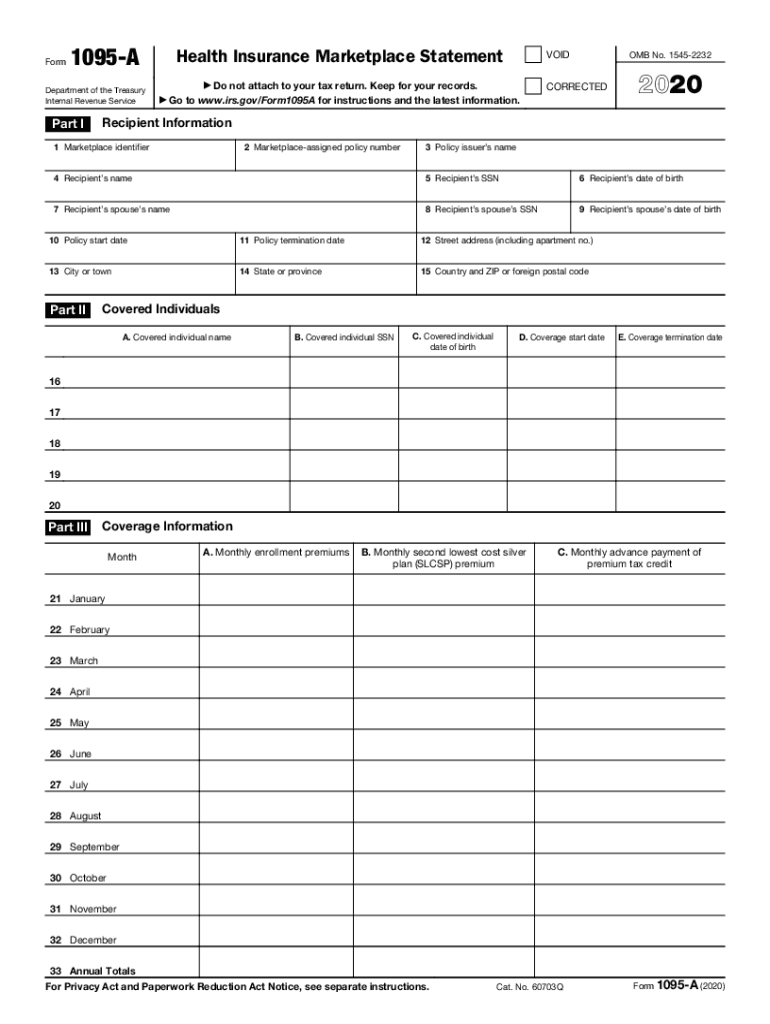

A 1095 shows information about your health plan for the year. You got health insurance through a federal or state marketplace. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace.

About Form 1095-A Health Insurance Marketplace Statement Internal Revenue Service. If you receive a 1095 keep your copy with your tax records. IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members.

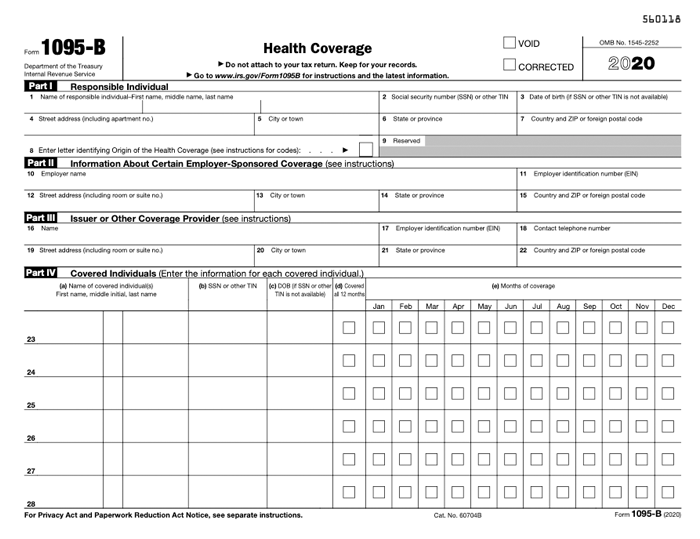

Form 1095-B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year. You can download or print current or past-year PDFs of Form 1095-A directly from TaxFormFinder. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government.

As a result Wellfleet Insurance Company will not be mailing the 1095-B form to members as. Insurance companies outside the Marketplace Government agencies such as Medicare or CHIP. If you qualify for marketplace tax credits based on income at tax time or if you took tax credits in advance youll need to reference a 1095-A form to file your Premium Tax Credit form form 8962.

The 1095-B form is sent to individuals who had health insurance coverage for themselves andor their family members that is not reported on Form 1095-A or 1095-C. Minimum essential coverage includes government-sponsored. We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government.

The 1095-B is sent by the Health Care Providers such as. Covered California refers to it as the California Premium Subsidy. It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return.

This Form 1095-B provides information about the individuals in your tax family yourself spouse and dependents who had certain health coverage referred to as minimum essential coverage for some or all months during the year. We last updated Federal Form 1095-A in January 2021 from the Federal Internal Revenue Service. Form 1095-B Health Coverage If you are enrolled in FEHB you may request IRS Form 1095-B from your FEHB carrier and receive this form within 30 days of your carrier receiving your request.

If you have Part A you may get IRS Form 1095-B from Medicare in the early part of the year. It is used by larger companies with 50 or more full-time or full-time equivalent employees. Federal 1095A subsidy statement is reported to form 8962 Premium Tax Credit and then moves on to the 1040 income tax return.

You do need your Form 1095 to file your federal return if. You can print other Federal tax forms here. Form 1095-C employer-provided health insurance offer and coverage shows the coverage that is offered to you by your employer.

How to use Form 1095-A If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. This form provides information of the coverage your employer offered and whether or not you chose to participate. You get Form 1095-A.

More about the Federal Form 1095-A Corporate Income Tax TY 2020 We last updated the Health Insurance Marketplace Statement in January 2021 so this is the latest version of Form 1095-A fully updated for tax year 2020. We last updated Federal Form 1095-B in January 2021 from the Federal Internal Revenue Service. More about the Federal Form 1095-B.

This form is for income earned in tax year 2020 with tax returns due in April 2021. Or your Carrier will furnish this form to you by March 2 2020. The Qualifying Health Coverage QHC notice lets you know that your Medicare Part A Hospital Insurance coverage is considered qualifying health coverage.

The new California subsidy was implemented in 2020. What forms will Federal employees receive. More about the Federal Form 1095-B Corporate Income Tax TY 2020 We last updated the Health Coverage in January 2021 so this is the latest version of Form 1095-B fully updated for tax year 2020.

If you dont get Form 1095-B dont worry. The Franchise Tax Board calls it the Premium Assistance Subsidy PAS. You must have your 1095-A before you file.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Kids Health Insurance Tax Information Florida Healthy Kids

Kids Health Insurance Tax Information Florida Healthy Kids

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.