You may find plans with no co-insurance requirements some with 2080 or 5050 coinsurance or other combinations. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan.

Who Pays After Deductible Coinsurance Not Listed Personal Finance Money Stack Exchange

Who Pays After Deductible Coinsurance Not Listed Personal Finance Money Stack Exchange

The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible.

30 coinsurance after deductible. If your plan has a 100 deductible and 30 co-insurance and you use 1000 in services youll pay the 100 plus 30 of the remaining 900 up to your out-of-pocket maximum. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance.

When you go to the doctor instead of paying all costs you and your plan share the cost. Now if your office visit costs 200 and you have 30 coinsurance you will pay 60 of the bill in addition to your copay. For example if you have a 20000 surgery bill your 30 coinsurance will be a whopping 6000.

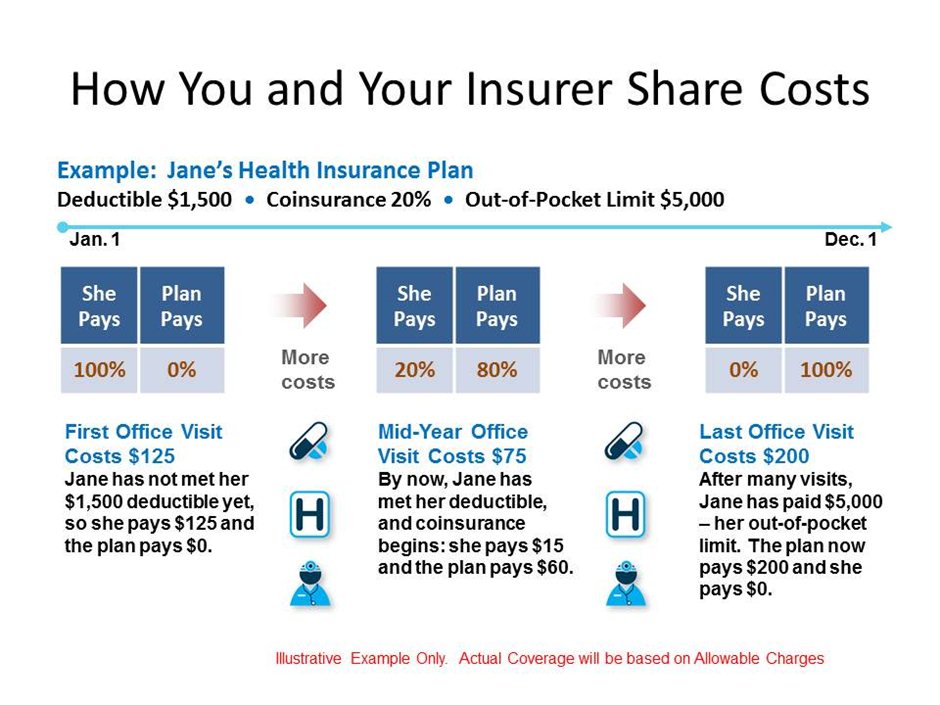

Coinsurance is a portion of the medical cost you pay after your deductible has been met. For instance with 10 percent coinsurance and a 2000 deductible. Out-of-pocket maximum of 5000.

Youve paid 1500 in health care expenses and met your deductible. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. It is your share of the medical costs which get paid after you have paid the deductible for your plan.

Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. A 30 copayment to fill a prescription or see a doctor will cost you 30 no matter how much the total bill for the prescription or office visit was.

You start paying coinsurance after youve paid your plans deductible. Its usually figured as a percentage of the amount we allow to be charged for services. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. Coinsurance is your share of the costs of a health care service. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20.

The 30 percent you pay is your coinsurance. You pay 20 of 100 or 20. Single Coverage - If you incur medical services that are subject to the deductible you will pay the first 250 of those costs and then 10 of the subsequent costs up to an annual maximum of 1000 in coinsurance payments.

Coinsurance is often 10 30 or 20 percent. Coinsurance is often 10 30 or 20 percent. For example your plan pays 70 percent.

Another common set up is 7030 you pay 30. Lets say your plan has a 0 deductible a 30 copayment for doctors visits and a 30 coinsurance for every other service. This is a simple calculation however that may not account for all of the complexity of your plan.

After you meet your deductible you usually pay coinsurance. But again as long as your plan isnt grandmothered or grandfathered your total out-of-pocket charges cant exceed 8150 in 2020 as long as you stay in-network and follow your insurers rules for things like referrals and prior authorization. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would.

Copays often apply regardless of whether youve reached your deductible. Your health insurance picks up the rest of the tab note that this generally only applies if you use an in-network provider and fulfill any prior authorization requirements that your insurance plan has. The insurance company pays the rest.

As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year. Before reaching your deductible you have to pay all of your medical costs. Coinsurance comes into play when your deductible runs out and depending on your deductible and your medical history that amount of.

30 for the visit and 4080 for the hearing test. Youll end up paying about 71 out-of-pocket for the hearing test. Coinsurance is health care costs sharing between you and your insurance company.

However coinsurance only applies after you spend enough to reach your deductible. If youve paid your deductible. For example if your coinsurance is 20 it means you pay 20 for covered health care services and your insurer pays the remaining 80.

Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. When you look at your policy youll see your coinsurance shown as a fractionsomething like 8020 or 7030. The coinsurance typically ranges between 20 to 60.

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Https Www Centergrove K12 In Us Site Handlers Filedownload Ashx Moduleinstanceid 9596 Dataid 20761 Filename 2020 20hdhp 20summary Pdf

Copay Vs Coinsurance The Differences And Why They Matter Nerdwallet

Copay Vs Coinsurance The Differences And Why They Matter Nerdwallet

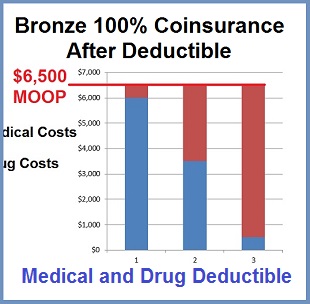

Coinsurance After Deductible How To Choose Between 100 And 0

Coinsurance After Deductible How To Choose Between 100 And 0

25 Awesome Health Insurance Deductible Vs Copay

25 Awesome Health Insurance Deductible Vs Copay

25 Best What Is Coinsurance After Deductible

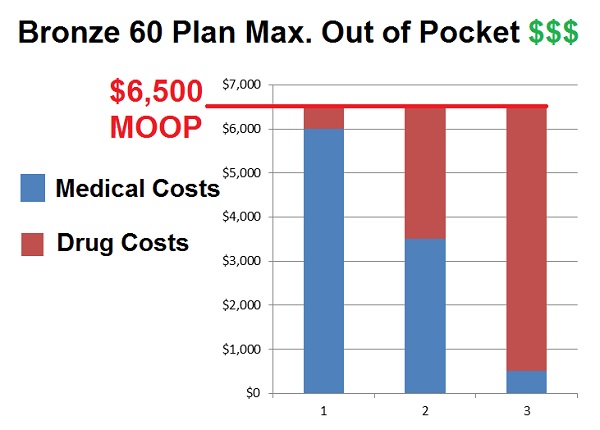

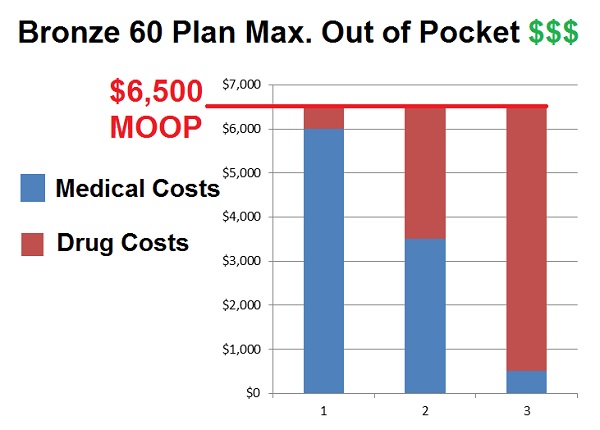

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

What Is A Deductible Copay And Coinsurance Policy Advice

What Is A Deductible Copay And Coinsurance Policy Advice

What Is Coinsurance Healthmarkets

What Is Coinsurance Healthmarkets

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

/GettyImages-73032716web-56f1a35b3df78ce5f83c2b81.jpg) Differences Between A Deductible And Coinsurance

Differences Between A Deductible And Coinsurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.