9 Zeilen In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household. An individual who makes up to 25760 or a family of four that earns 53000 will be required to contribute up to 2 of their income toward their premium down from the 652 they pay currently.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

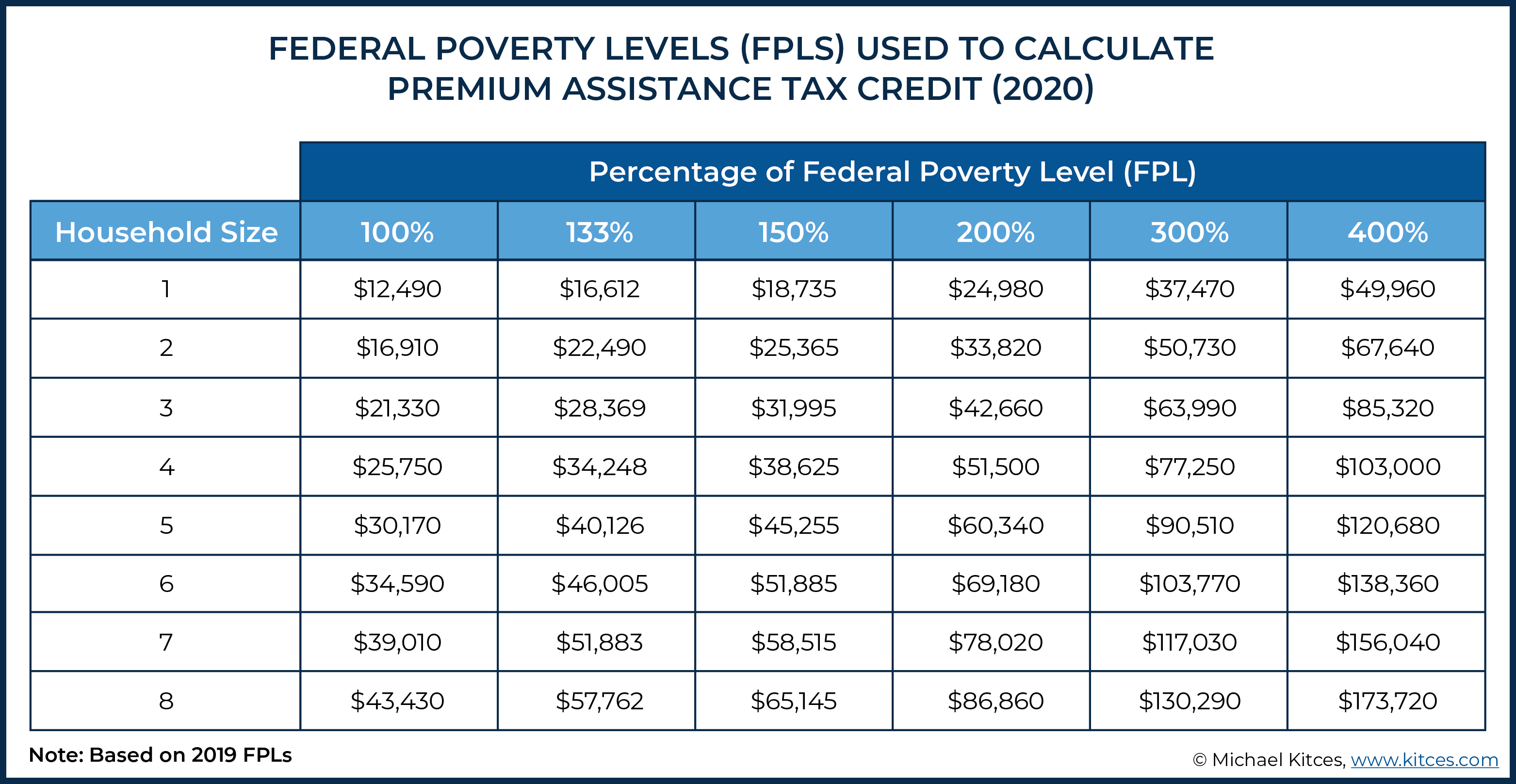

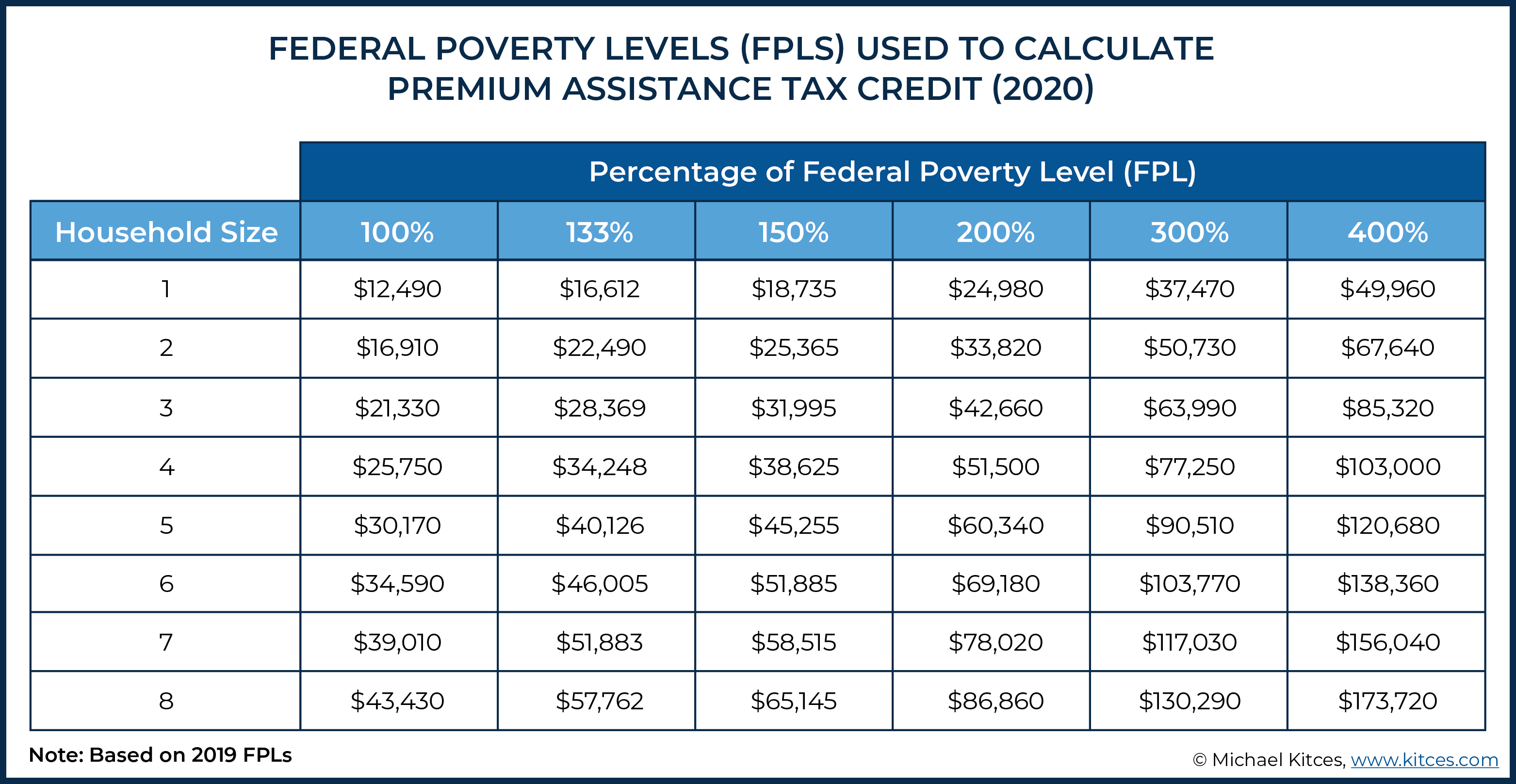

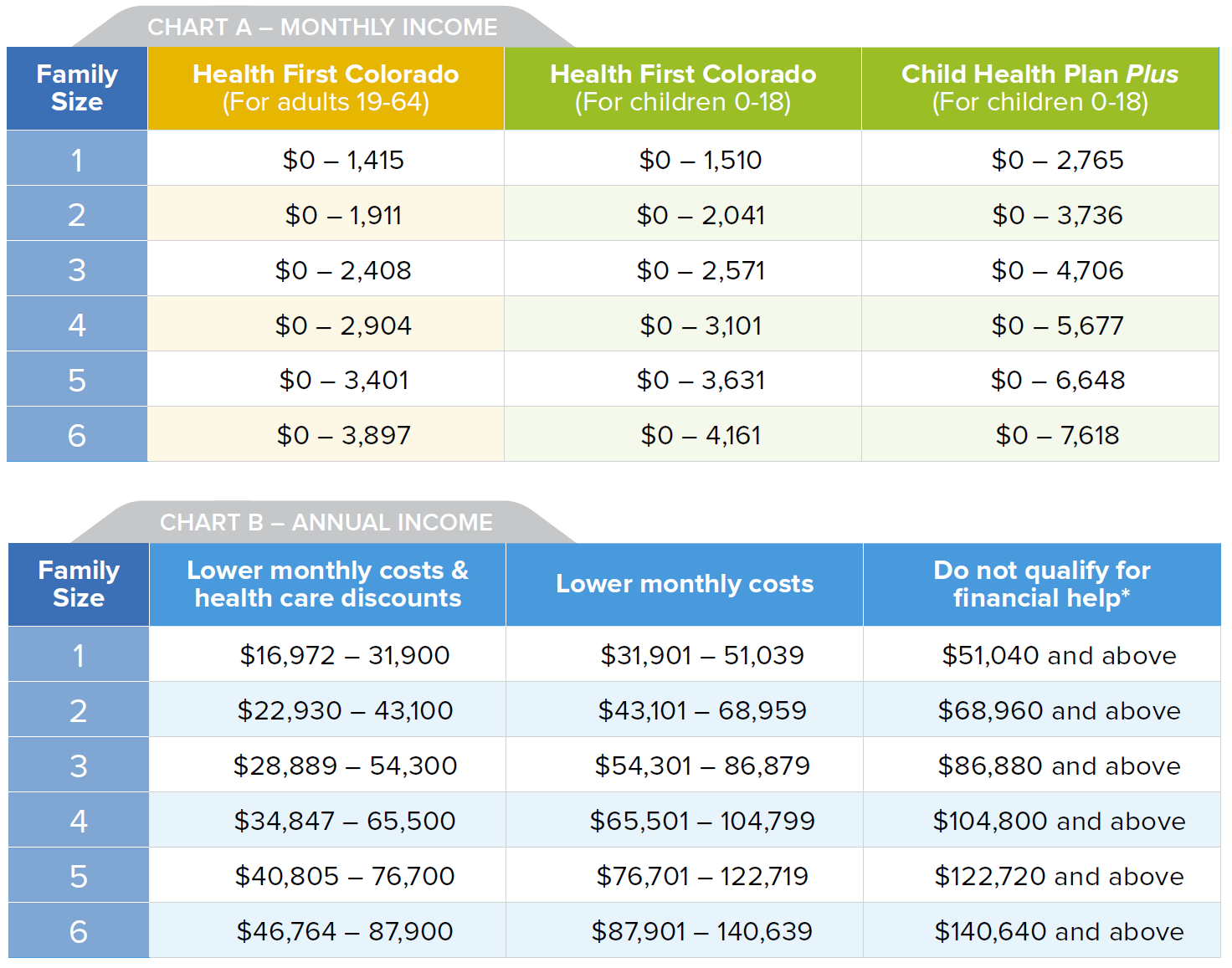

Most people are eligible for subsidies when they earn 400 or less of the federal poverty level.

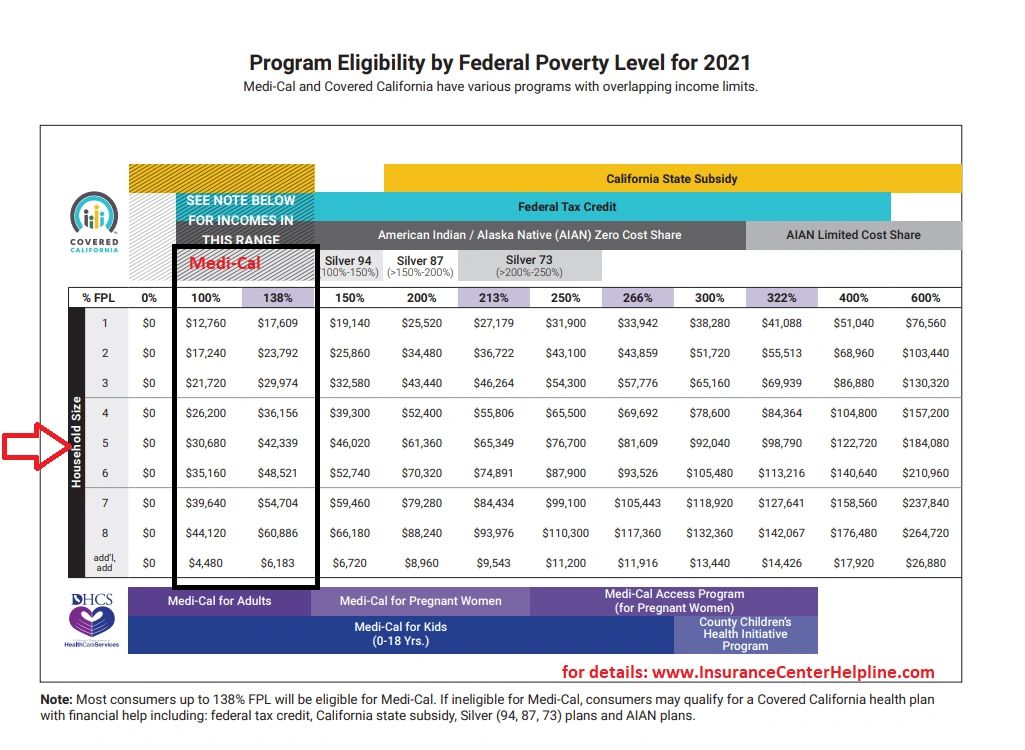

What is the maximum income for getting obamacare premium assistance. 2020 2021 2022 Federal Poverty Levels FPL For ACA Health Insurance. 2021 ACA Income Limits for Tax Credit Subsidies Income Limits for 2021 ACA Tax Credit Subsidies on healthcaregov Based on eligibility and your family size and Modified Adjusted Gross Income MAGI on your future 2021 Tax Returns you may qualify for subsidies to lower your net premiums on the ACA Health Insurance Marketplace. They limit the amount you pay in monthly premiums to a percentage of your annual income.

For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000. What is the maximum income for ObamaCare.

What is the maximum income for ObamaCare. Estimating your expected household income for 2021. Again subsidies have increased for 2021 and will remain larger.

23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies. In addition to get the tax credits before 2021 and after 2022 your household income had to be less than 400 of the federal poverty level. So yes in years that you claim your son as a tax dependent youre considered a household of two and youd be eligible for a premium subsidy with an income of up to 400 of the poverty level for a household of two for 2021 coverage that will be 68960.

How do you know if you qualify for a premium subsidy on your ACA policy. For example if your income is between 100 and 133 of the FPL subsidies will cover any premium costs above 206 of your annual household income. It raises by about 100 a year.

People who dont have health insurance from work can buy health coverage under the Affordable Care Act also known as Obamacare. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. Marketplace savings are based on your expected household income for the year you want coverage not last years income.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. This premium assistance credit can be worth thousands of dollars per year. You must make your best estimate so you qualify for the right amount of savings.

In 2015 the minimum income for ObamaCare cost assistance was 11770. Premium subsidy eligibility on the other hand is based on annual income. So we should be paying 589000 per year.

Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income. Answer For 2021 coverage those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify for ObamaCare. Obamacare Subsidy Eligibility Obamacare offers subsidies also known as tax credits that work on a sliding scale.

The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off your income relative to the Federal Poverty. Well make it easy. When you fill out a Marketplace application youll need to estimate what your household income is likely to be for the year.

You can probably start with your households adjusted gross income and update it for expected changes. The income limit for subsidy eligibility is based on the size of your tax household. Meanwhile on 2018 plans bought during 2018 open enrollment Nov 1 - Dec 15 2017 the minimum income for the marketplace is 12060.

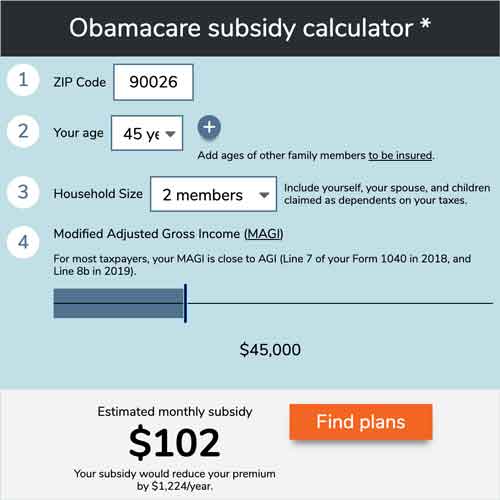

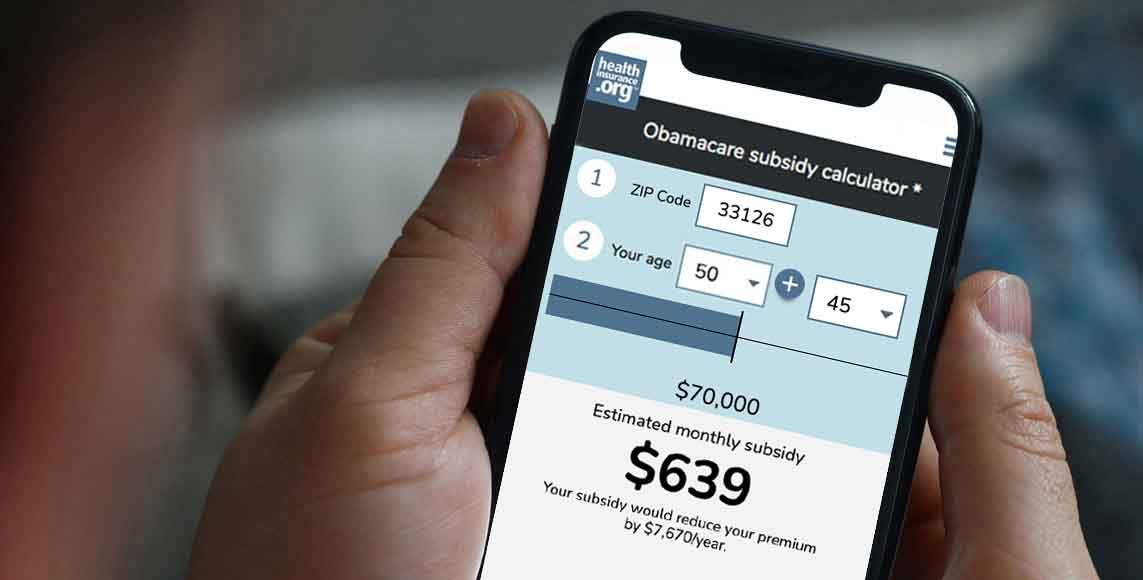

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. Seems more like we would be paying 19 of our actual income. If youre at 300 to 400 of the FPL youll be responsible for premium costs up to 978 of your household income and the government will subsidize the rest.

Since our actual income is around 62000 based on your scenario the maximum we should have to pay is 95 of our income. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

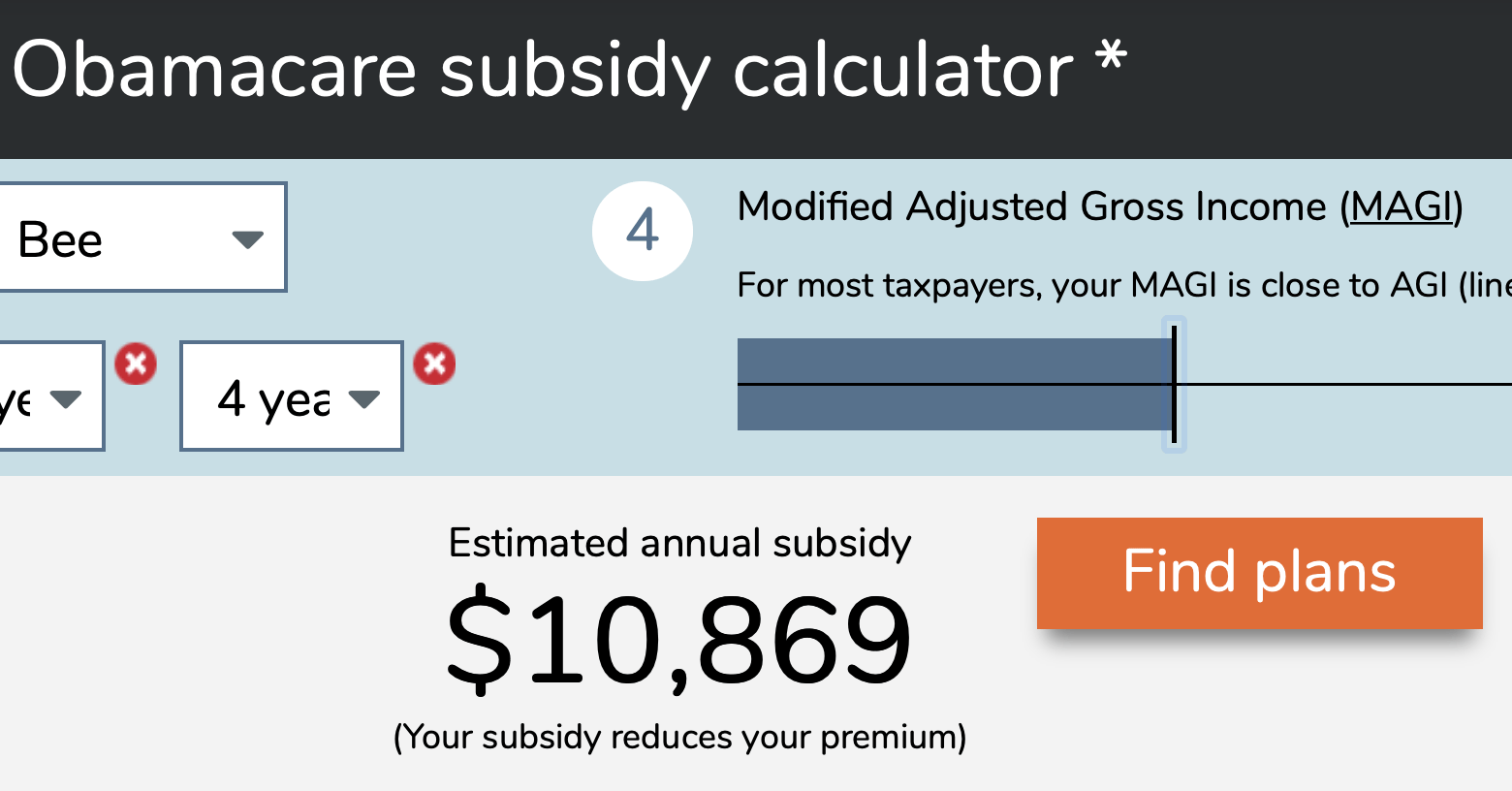

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

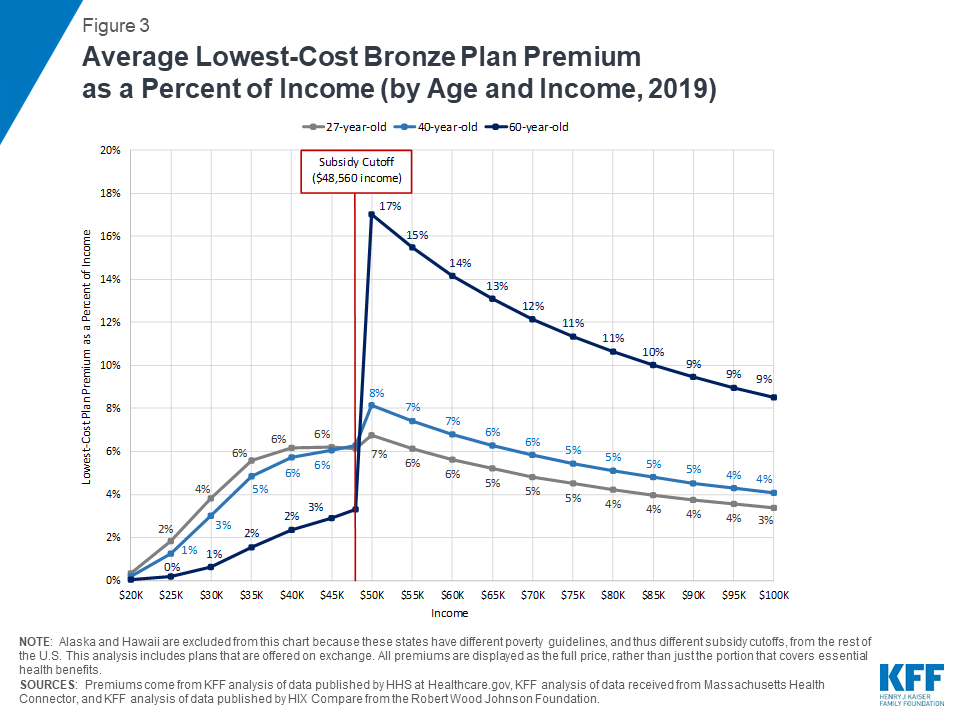

How Affordable Are 2019 Aca Premiums For Middle Income People Kff

How Affordable Are 2019 Aca Premiums For Middle Income People Kff

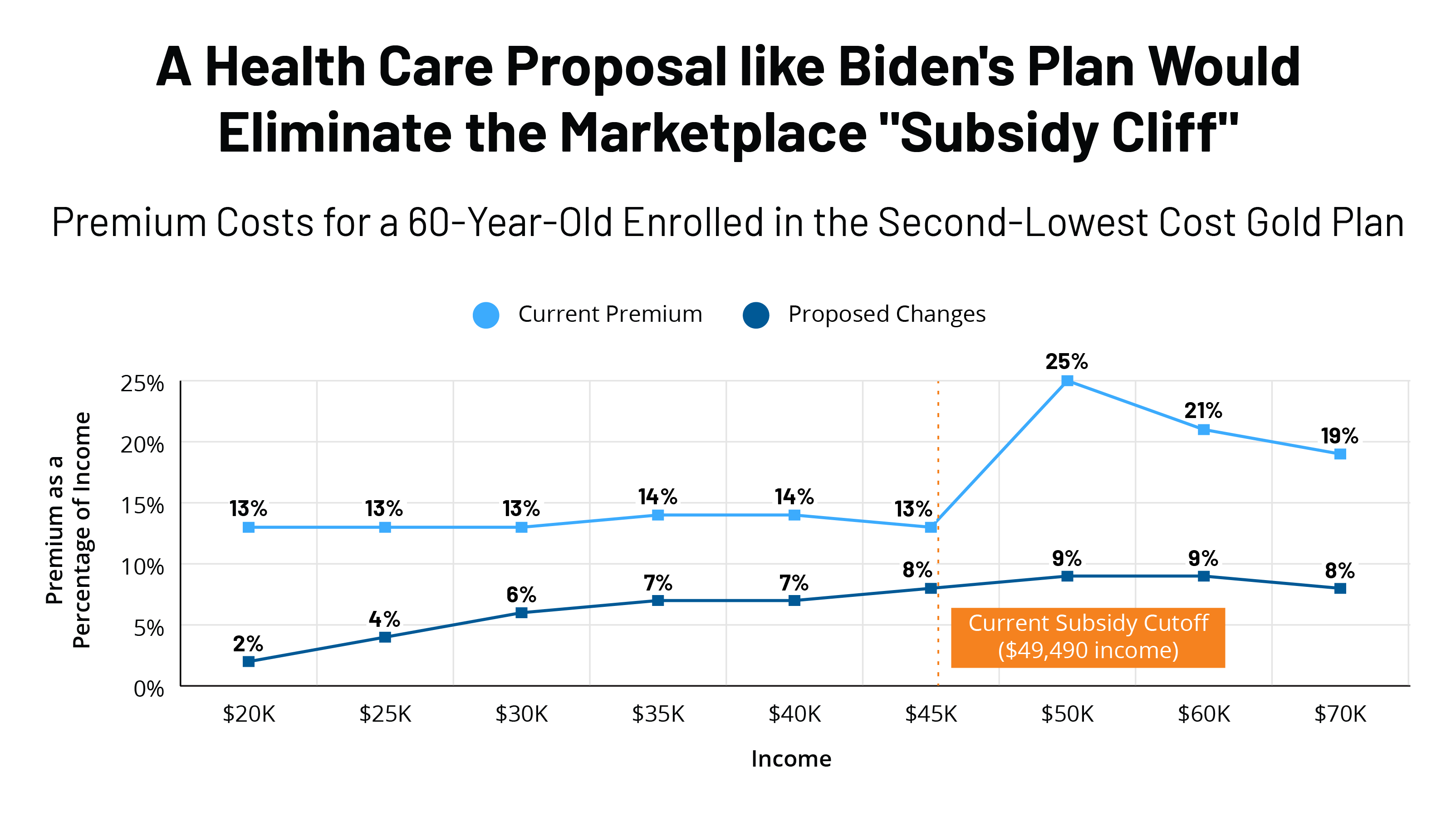

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.