Part B covers things like. 2 ways to find out if Medicare covers what you need.

Do I Need Medicare Part B What Is Part B Boomer Benefits

Do I Need Medicare Part B What Is Part B Boomer Benefits

If your employer has 20 or more employees the employer group health plan usually is the primary insurance and Medicare is the secondary insurance.

Medicare part b secondary coverage. Employer coverage over 20 employees. Along with Medicare Part A hospital insurance it makes up Original Medicare the federal health insurance program. One-shot per year each cold season has coverage through Part B.

If the insurance company doesnt pay the Claim promptly usually within 120 days your doctor or other provider may bill Medicare. Heres something important to know about Medicare Part B. You are disabled and are covered by a GHP through employment or a spouses employment AND the employer has over 100 employees.

Medicaid is your secondary insurance. Normally youd be responsible for the remaining 20. If your primary payer was Medicare Medicare Part B would pay 80 percent of the cost and cover 80.

Situations when Medicare is a secondary payer include when. Prosthetic benefit for individuals with permanent dysfunction of the digestive tract. Durable medical equipment DME Mental health Inpatient.

You need this coverage if you decide to sign up for a Medicare Advantage plan or buy a Medicare Supplement insurance plan. Part B Coverage Criteria. In this case Medicare is secondary to the employer plan.

Yet those without creditable coverage who delay enrollment into Part B could incur a Part B late enrollment penalty. But before you drop Part B find out if your jobs coverage is primary or secondary to Medicare. A primary payer health plan pays before Medicare.

Use of TPN for a minimum of 90 days. If medical record including the judgment or the attending physician indicates that the impairment will be long and indefinite duration the test of permanence is met. When Medicare coordinates benefits with other health insurance coverage providers there are a variety of factors that play into whether Medicare is the primary secondary or in very.

GHP pays Primary Medicare pays secondary. You are covered by a group health plan GHP through employment self-employed or a spouses employment AND the employer has more than 20 employees. If you have health insurance that is secondary to Medicare meaning it will pay after Medicare does and drop Part B coverage you risk having your insurance plan deny claims that Medicare would have paid for.

A person has a GHP through their own or a spouses employment and the employer has more than 20 employees a. If your employer insurance is the secondary payer you may need to enroll in Medicare Part B before your insurance will pay. A seasonal H1N1 vaccine falls under the flu umbrella.

Limited outpatient prescription drugs. You can delay Part B without penalty if you have creditable employer health coverage from a large employer. Your group health plan may pay your Medicare deductibles.

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit up to any limit established by the policies of the secondary payer coverage terms. Individual is age 65 or older is self-employed and covered by a GHP through current employment or spouses current employment AND the employer has 20 or more employees or at least one employer is a multi-employer group that employs 20 or more individuals. That means your employer-provided health plan will cover its share of your health care costs first and if theres anything left over that Medicare covers Medicare will pay what remains.

If this happens you may have to pay the full cost out of your pocket. It pays after Medicare. In this case your group health plan is the primary payer and Medicare.

You may also face late penalties. Medicare is secondary so you can delay Part B until you retired if you want to. If you have a secondary.

Its also possible to delay Part B if you reach age 65 and have creditable coverage through your employer. The decision as to who is responsible for paying first on a claim and who pays second is known in the insurance industry as coordination of benefits 4. Medicare may be the secondary payer when.

H1N1 is swine flu. Medicare is typically the secondary payer if the company you work for has 20 or more employees. Medicaid may pay your Medicare deductibles and coinsurance.

Medicare Secondary Payer MSP is a term used when Medicare is not responsible for paying first on a healthcare claim. Keep in mind that both parts of Medicare can coordinate with large employer coverage to reduce your spending. Meaning immunizations like the influenza virus vaccine are part of the benefits.

Enrollees typically have a 0 out. GHP pays Primary Medicare pays secondary. Clinical research Ambulance services.

Medicare Part B is medical insurance. The secondary payer which may be Medicare may not pay all the uncovered costs. Sole source of nutrition.

Talk to your doctor or other health care provider about why you need certain services or supplies.

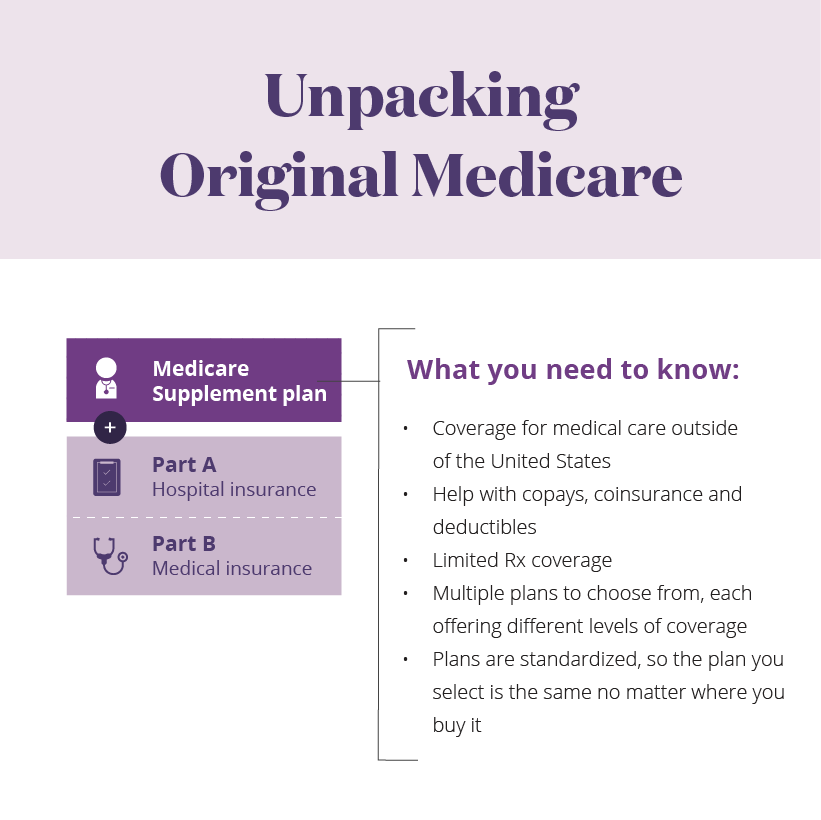

Medicare Supplement Additional Coverage For Parts A And B Aetna Medicare

Medicare Supplement Additional Coverage For Parts A And B Aetna Medicare

Medicare Part B Outpatient Coverage What Does Medicare Part B Cover

Medicare Part B Outpatient Coverage What Does Medicare Part B Cover

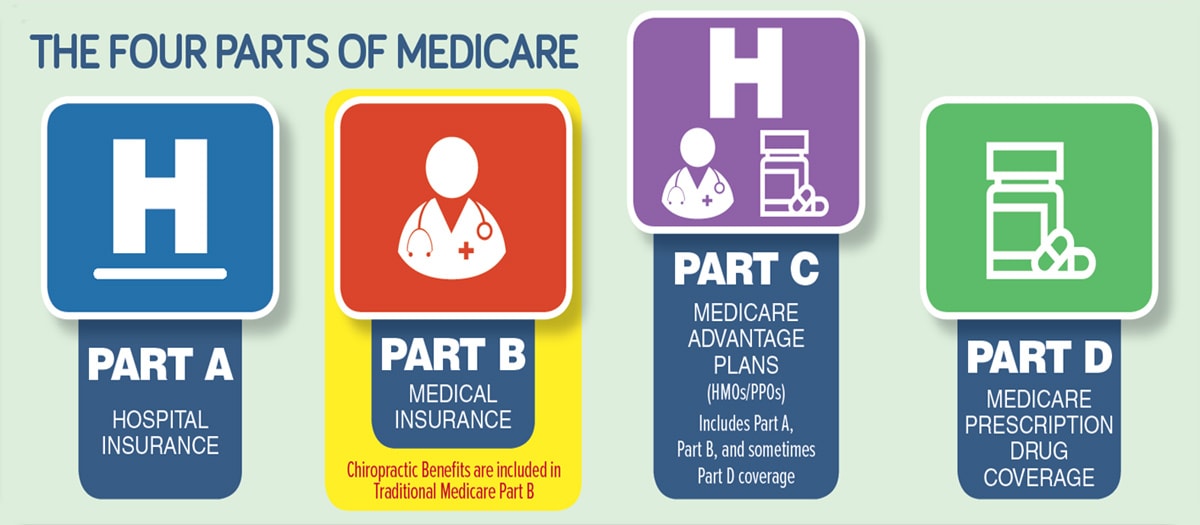

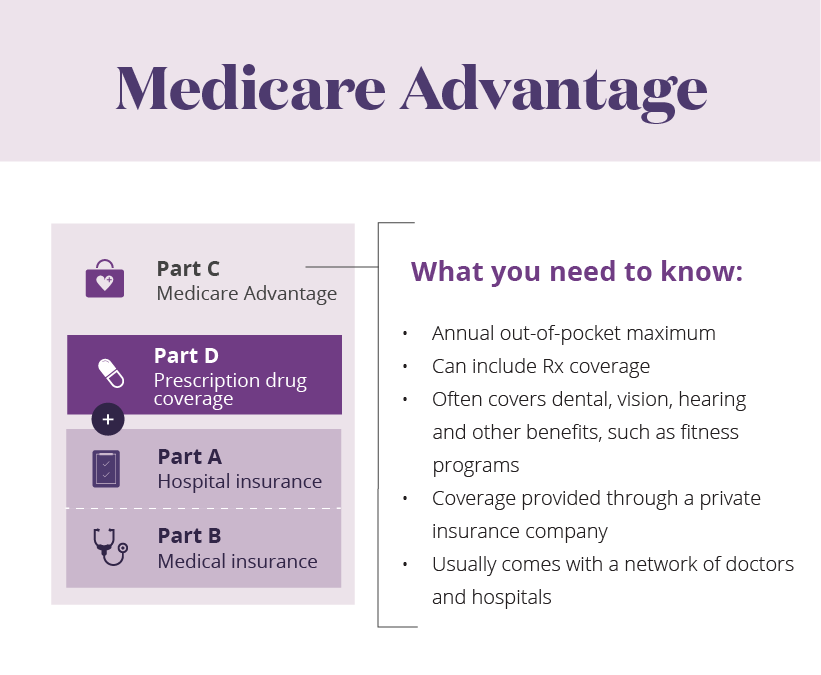

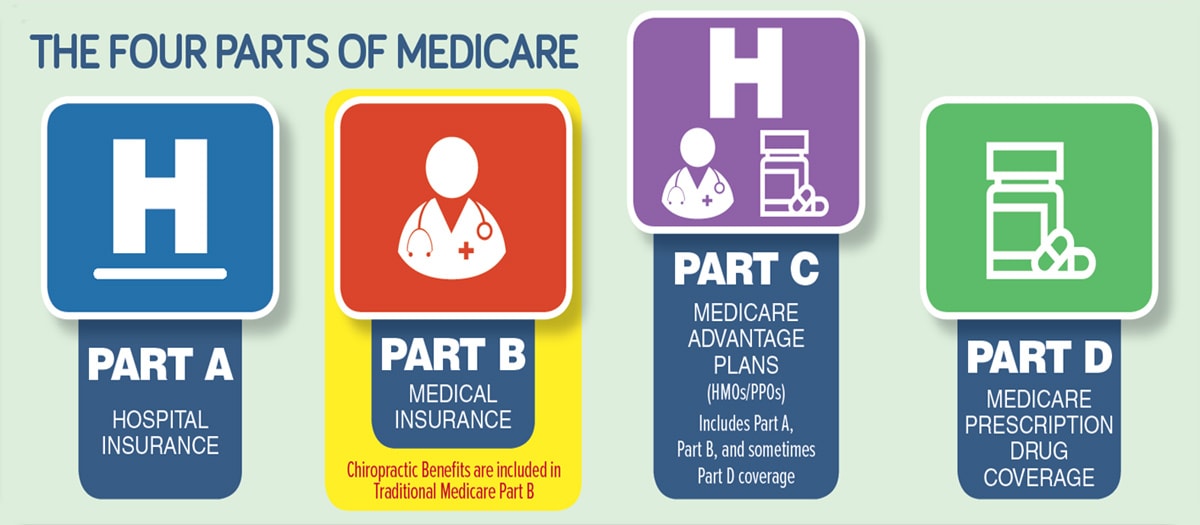

Medicare Benefits Parts A B C And D Medical Mutual Of Ohio

Medicare Benefits Parts A B C And D Medical Mutual Of Ohio

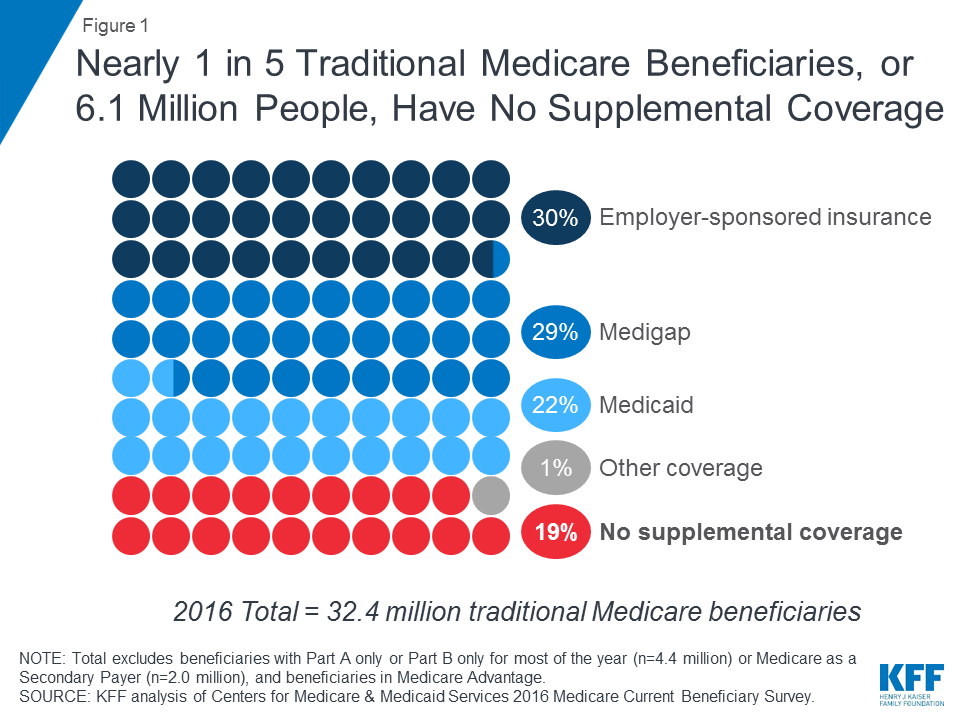

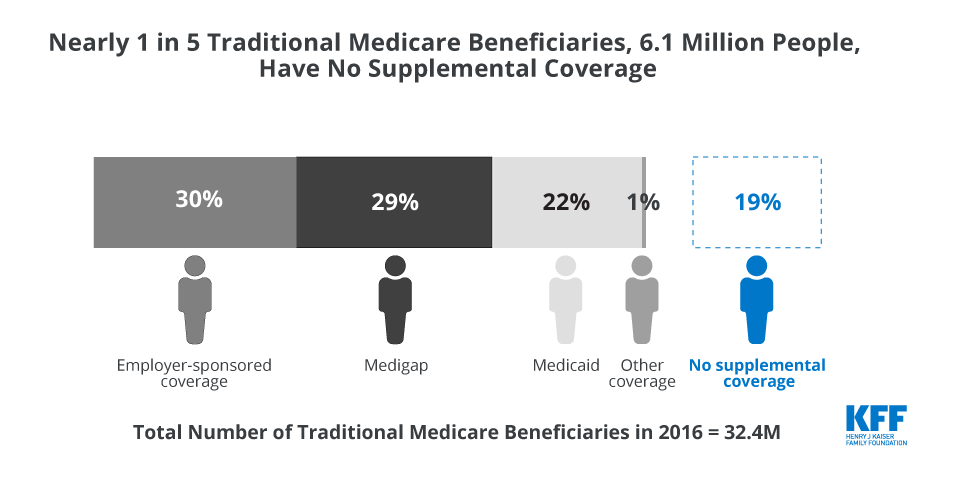

Sources Of Supplemental Coverage Among Medicare Beneficiaries In 2016 Kff

Sources Of Supplemental Coverage Among Medicare Beneficiaries In 2016 Kff

Medicare As A Secondary Insurance Customer

Medicare As A Secondary Insurance Customer

Learn About The Parts Of Medicare Aetna Medicare

Learn About The Parts Of Medicare Aetna Medicare

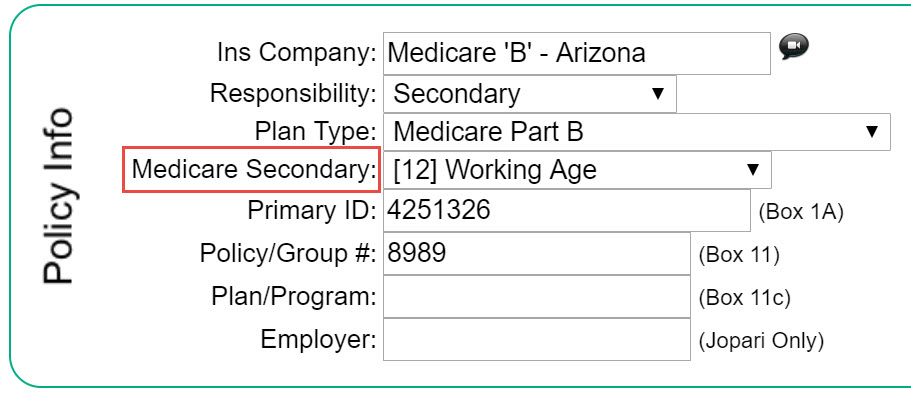

Medicare Secondary Payer Msp Code Therabill

Medicare Secondary Payer Msp Code Therabill

Sources Of Supplemental Coverage Among Medicare Beneficiaries In 2016 Kff

Sources Of Supplemental Coverage Among Medicare Beneficiaries In 2016 Kff

What Does Medicare Part B Cover As A Secondary Insurance Change Comin

What Does Medicare Part B Cover As A Secondary Insurance Change Comin

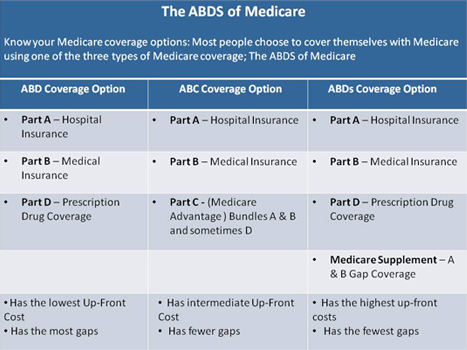

Know All Types Of Primary Medicare Coverage Kmc University

Know All Types Of Primary Medicare Coverage Kmc University

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

Medicare And The Marketplaces 2017 Medicare Rights Center

Medicare And The Marketplaces 2017 Medicare Rights Center

Https Med Noridianmedicare Com Documents 10525 2052366 Medicare Secondary Payer Form

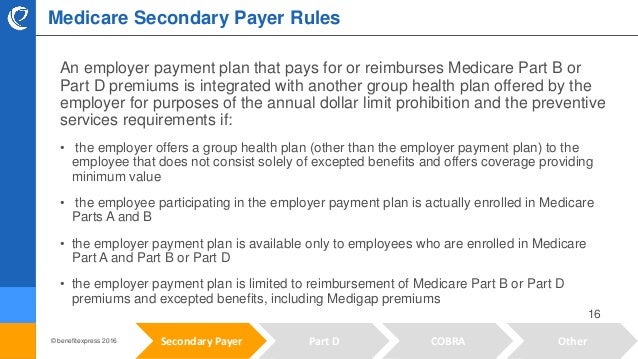

Medicare Rule Review Overview Of Secondary Payers

Medicare Rule Review Overview Of Secondary Payers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.