You have no deductible no coinsurance and no copays. Part G can be purchased by anyone who became eligible for Medicare after January 1 2020.

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Now Plan Ga new option for new Medicare enrollees beginning January 1 2020offers the closest available coverage to what was Plan F.

Compare medicare plans g and f. Part F is also only available to those who were eligible for Medicare before January 1 2020 or who had already enrolled in the plan before that date. Medicare Supplement G Plans have stepped up as the leader in having the lowest out-of-pocket costs covering everything F plans do with the exception of the Part B deductible 198 in 2020. In a 2017 survey of medigap plan f vs g 55 of all Medicare Supplement Insurance beneficiaries were enrolled in Medigap Plan F which was by far the most popular type of Medigap plan.

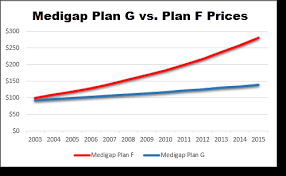

Even though it has similar coverage Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F. Plan G is only slightly different so it is also a popular seller. 2 Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers except for the Medicare Part B deductible.

Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183. This means that you will have to pay 183 annually before Plan G begins to cover anything. When you compare Plans F and G side by side youll immediately notice that.

Medicare Supplement Plans F and G are identical with the exception of one thing. Coverage of Medicare Part B deductible in the plan g vs plan f options. 16 Zeilen Most people will select Plan F or Plan G.

This means the first dollar is covered by Medicare. 12 Zeilen Plans F and G also offer a high-deductible plan in some states. Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F.

What is the difference between Medicare Supplement Plans F G. Plan F is the best plan and Plan G is the. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

This means Medigap Plan F pays the 203 while Plan G does not. Plan G was the second-most popular Medigap plan type with 13 of all Medigap enrollees. To help you find the best Medicare Supplement Plan G provider we compared and ranked the top plans taking into consideration price discounts geographic coverage.

The main difference is that Plan F covers the Medicare Part Bdeductible while Plan G doesnt. However once the Part B deductible for Plan G is paid for you essentially have Plan. As you can see in the Medigap comparison chart Plan F covers all the gaps in Medicare.

The 2021 Part B deductible is 203 per year 1692 per month. In some cases the difference in premiums between the two plans. Both plans also have a high-deductible option.

Plan G would be higher than the Part B deductible itself. If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself. Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible.

The current part B deductible cost is 203. All you have to pay is your monthly premium. Plan G enrollment spiked 39 percent in recent years.

Even though Plan G doesnt cover the Part B deductible some Plan F options could have high enough premiums that the cost difference between Plan F vs. Medigap Plan G provides a person with coverage for some parts of healthcare that original Medicare does not cover. In 2021 this deductible is set at 2370 which must.

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. However Plan G does not cover the Medicare Part B deductible which is 14850 in. After you pay your deductible you have no other out-of-pocket costs just like the Plan F.

The other difference is price and it is a considerable one. It leaves you to pay the Part B deductible whereas Medigap Plan F. However while Plan G is available to any new entrant to Medicare Plan F policies cannot be obtained by those new to Medicare after January 1 st 2020.

Medicare Supplement Plan G covers most of the out-of-pocket. With a Plan G the only cost you have to pay out of pocket is the Part B deductible. Medicare supplement plans G and F are virtually identical aside from the fact that Plan F covers a Part B deductible.

After youve met the deductible Plan G will cover the rest just like Plan F. In addition monthly premiums vary from policy to policy so it is always in your interest to compare multiple policies before purchasing have knowledge of What is Medicare Part G and F. If a Plan F option includes premiums that cost more in a year than the price of a Plan G policy plus the Medicare B deductible 203 in 2021 then a beneficiary would save money by enrolling in Plan G.