Regarding 1095-A availability. You can learn more about this topic at the IRS website or talk with your tax advisor.

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

So for fully insured groups Anthem plans to send out tax form 1095-B as originally scheduled.

Anthem 1095 a. Select Tax forms from the menu on the left. Select your 2014 application be sure youre not choosing your 2015 coverage application. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace.

Form 1095-A rather than a Form 1095-B. If two or more tax filers are enrolled in one policy each tax filer receives a statement reporting coverage of only the members of that. FTB 3895 and 1095A look very similar.

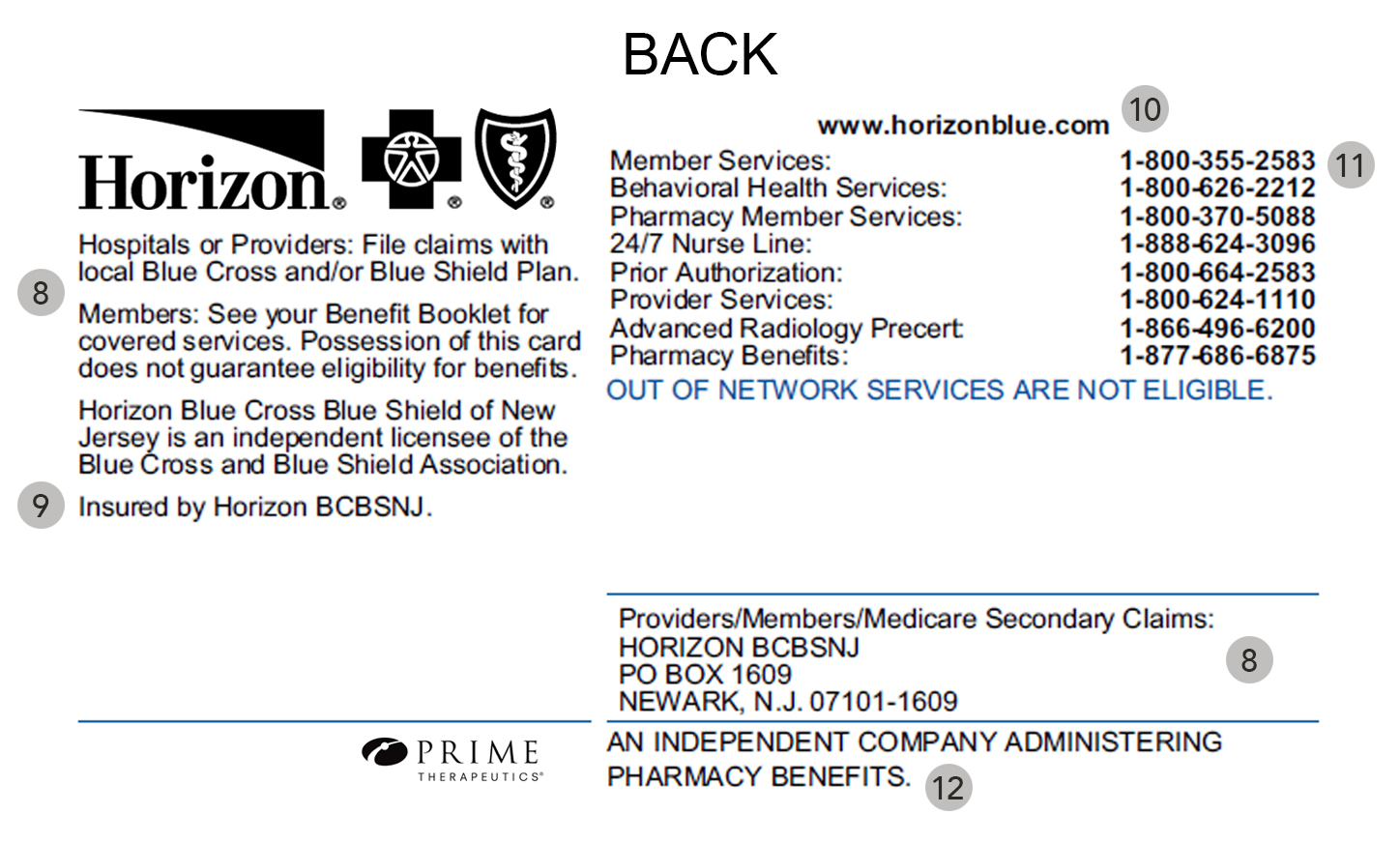

Or you can call Customer Service on your ID card if you have further questions. If you or another family member received employer-sponsored coverage that coverage may be reported on a Form 1095-C Part III rather than a Form 1095-B. Impact on individual taxpayers In some cases taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their 2018 tax returns.

For more information see. Form 1095-A is provided here for informational purposes only. Download all 1095-As shown on the screen.

Form 1095-A is provided here for informational purposes only. Shop plans for Medicare Medical Dental Vision Employers. Marketplaces use Form 1095-A to furnish the required statement to recipients.

A January presentation on Form 1095-A from Covered California went over getting a corrected 1095-A making changes to the 2014 account and how not to expect much help from exchange itself. If you enrolled in coverage through the Marketplace you will receive a Health Insurance Marketplace Statement Form 1095-A. Our goal is to have all forms mailed by the end of February.

If you misplaced a 1095-A you can find it online. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace. At the end of the year we start getting a lot of questions from Covered California members about their 1095-A Form.

On the contrary a Covered California supervisor told me this morning that most 1095-A forms have been mailed and are available online. Click here if you purchased your plan via healthcaregov. 1095-A reports the tax credit advanced.

When will I receive my form. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a. I have not been able to confirm this readers comment that 1095-A forms are on hold.

Official Site of Anthem Blue Cross Blue Shield a trusted health insurance plan provider. How to find your 1095-A online Log in to your HealthCaregov account. In reality determining the Annual and Monthly Contribution Amount on Form 8962 was performed when the family first enrolled.

As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov. You can also find the information on your 1095 yourself or request another copy from the Marketplace. Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file.

A separate Form 1095-A must be furnished for each policy and the information on the Form 1095-A should relate only to that policy. Contact Your Insurer Directly. People start getting their paperwork ready to do their income taxes and want to know when and how they will be receiving this form.

Find your Form 1095-A online. Theres only one place where you can get a copy of your 1095 tax form. Under Your Existing Applications select your 2020 application not your 2021 application.

Save Time With Live Chat Find the information you need about your health care benefits by chatting with an Anthem representative in real-time. However if that 1095-A is incorrect for any reason the tax payer may have to invest significant time to get a corrected copy. Your insurance companyContact them directly ONLY your insurer will have access to it and can provide you with a copy.

If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095-A which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. Look for Form 1095-A If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. If you get healthcare from your employer contact your companys benefits.

Log in to Marketplace account. As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov. It comes from the Marketplace not the IRS.

The 2020 California Premium Assistance Subsidy is reconciled similar to the federal subsidy. Select Tax Forms from the menu on the left. The 1095-A Health Insurance Marketplace Statement is the report of.

1095-A federal health insurance subsidy statement. Browse commonly requested forms to find and download the one you need for various topics including pharmacy enrollment claims and more. Make sure the data from each statement is entered on the correct federal 8962 or California 3849 form.