Its also advisable to have an IRS form 8962 instructions file. Name shown on your return.

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

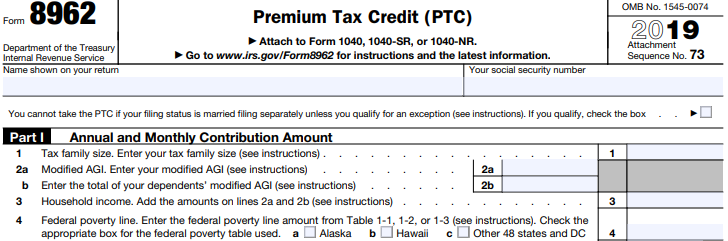

Before you dive in to Part I write your name and Social Security number at the top of the form.

Where can i find form 8962. Steps to Fill out Online 8962 IRS Form. Form 8962 is to calculate and claim the Premium Tax Credit PTC. Did you receive a 1095-A.

Where can i find form 8962. Next you need to enter your basic information. An individual needs 8962 Form to claim the Premium Tax Credit.

This is done in the Healthcare section of your account. It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf. Open the doc and select the page that needs to be signed.

The PTC is a refundable tax credit that you can claim by eligible tax payers and families earning and falling between the zero to moderate incomes. A Form 8962 will be included in the PDF of your 2017 tax return if you entered a Form 1095-A in the Health Insurance section of the program. Be sure to check if the letter references tax.

This is to aid the taxpayers afford and benefit from. If you included the information from your 1095-A form when you completed the Health Insurance section of TurboTax then your form 8962 was included in your return. Part I is where you record annual and monthly contribution amounts using your family size.

Part I is where you enter your annual and monthly contribution amounts. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. 8962 Form Fill Online By clicking the link above you can.

To access your current or prior year online tax returns sign onto the TurboTax website with the userID you used to create the account - Geschätzte Lesezeit. Get form 8962 2018 signed right from your smartphone using these six tips. Search for the document you need to e-signelectronically sign on your device and upload it.

The 8962 form will be e-filed along with your completed tax return to the IRS. You can apply digital IRS form 8962 to learn your PTC amount. If you filled out the form during one of the previous years itll make an example of form 8962 filled out.

Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. Go to wwwirsgovForm8962 for instructions and the latest information. This form is only used by taxpayers who purchased a health plan through the Health Insurance Marketplace including healthcaregov.

Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. Search for the document you need to e-signelectronically sign on your device and upload it. Get irs form 8962 printable signed right from your smartphone using these six tips.

Form 8962 is available on the IRS website. IRS Form 8962 A premium tax credit or PTC is a type of refundable tax credit that allows low income and middle income individuals and families cover the premiums of health insurance bought in the Health Insurance Marketplace. To speed the process try out online blanks in PDF.

Your social security number. Open the doc and select the page that needs to be signed. What is a 8962 Form Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace.

The annual total amount found on line 33 of your 1095-A goes on line 11 of your Form 8962. Form 8962 is divided into five parts. If you dont have an account yet register.

You need to get IRS Form 8962 from the Department of the Treasury IRS or through various online portals where you can download it as a PDF. The monthly amounts listed on lines 21-32 of your 1095-A go on lines 12-23 of your Form 8962. 3 Form 8962 is a two-page form broken into five parts.

After you complete your return we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. If you dont have an account yet register. Youll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR.

Turbo Tax can help you complete a Form 8962 if you have received a letter from the IRS asking for an update. Its only required to fill empty fields with your data. Form 8962 is used to figure the amount of Premium Tax Credit and reconcile it with any advanced premium tax credit paid.