Due to the Affordable Care Act enacted in May 2010 insurance companies are required to spend a specified. Medical Loss Ratio Requirements Under the Patient Protection and Affordable Care Act Congressional Research Service Summary The 2010 Patient Protection and Affordable Care Act ACA PL.

Behind The Scenes At A Health Insurer How The Money Is Made Or Why The Medical Loss Ratio Matters Clear Health Costs

Behind The Scenes At A Health Insurer How The Money Is Made Or Why The Medical Loss Ratio Matters Clear Health Costs

If insurers exceed that limit they have to send rebates to their members.

Affordable care act medical loss ratio. The federal Affordable Care Act of 2010 ACA created the first uniform minimum Medical Loss Ratio MLR standard. This is called the medical loss ratio rule health plans must spend at least eighty to 85 of every dollar on medical costs such as hospitals doctors prescription drug. The Affordable Care Act requires insurance companies to spend at least 80 or 85.

The Patient Protection and Affordable Care Act ACA set limits on insurers overhead mandating a medical loss ratio MLR of at least 80 percent in the individual and small-group markets and 85 percent in the large-group market starting in 2011. The Affordable Care Act requires health plans to spend a certain amount of the money they get from premium payments on medical services and quality improvement efforts. It also requires them to issue rebates to enrollees if this percentage does not meet minimum standards.

But the ACA imposed a medical loss ratio MLR requirement which specifies the maximum percentage of premiums that insurers can spend on administrative costs. Medical Loss Ratio MLR A basic financial measurement used in the Affordable Care Act to encourage health plans to provide value to enrollees. If an insurer uses 80 cents out of every premium dollar to pay its customers medical claims and activities that improve the quality of care the company has a medical loss ratio of 80.

July 07 2020 - The medical loss ratio is a financial standard that plans on the Affordable Care Act exchanges must uphold. . Medical Loss Ratio.

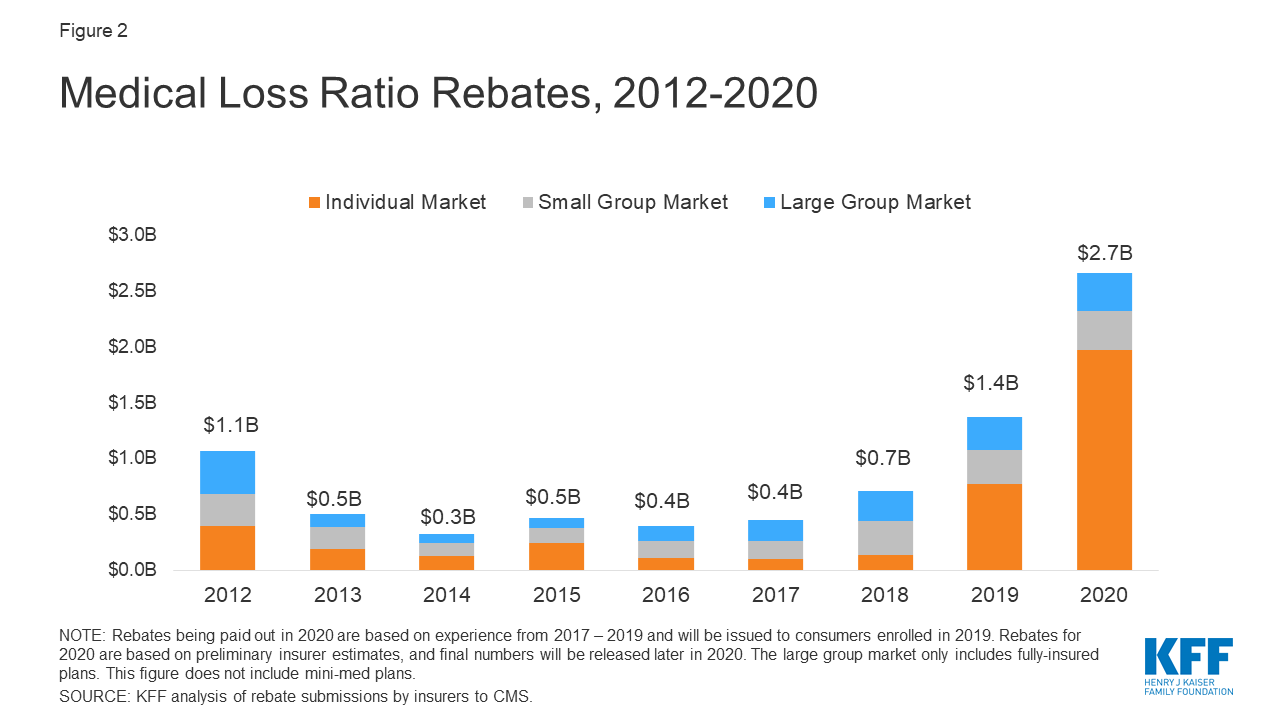

An agency within the US. Its all thanks to the Affordable Care Acts medical loss ratio MLR a provision sponsored by Minnesotas former Senator Al Franken that forces health insurance companies to use your premium dollars to provide actual health care and quality improvements for plan participants or return that money to you. The Affordable Care Acts 8020 rule delivered 137 billion in premium refunds to 89 million Americans in 2019 its eighth year The Affordable Care Acts medical loss ratio returned 137 billion to 89 million American consumers in its eighth year.

The ACA-MLR requires health insurance issuers in the individual and small group markets and large group market to spend at least 80 and 85 respectively of their premium income on medical care and health care quality improvement leaving the remaining 20 or 15. Important Information Regarding the Medical Loss Ratio MLR Rebate Please note this is a unique situation that only affects a small group of taxpayers. 200 Constitution Ave NW.

This policy is known as the medical loss ratio MLR provision of the Affordable Care Act. The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement also known as the Medical Loss Ratio MLR. Employee Benefits Security Administration.

These rebates were mandated under the Patient Protection and Affordable Care Act PPACA whenever health insurers do not spend at least a certain percentage generally 80 percent to 85 percent. 111-148 requires certain health insurers to provide consumer rebates if they do not meet a set financial target known as a medical loss ratio MLR. A medical loss ratio of 80 indicates that the insurer is using the.

Medical loss ratio applies to all health insurance plans including job-based coverage and coverage sold in the individual market.