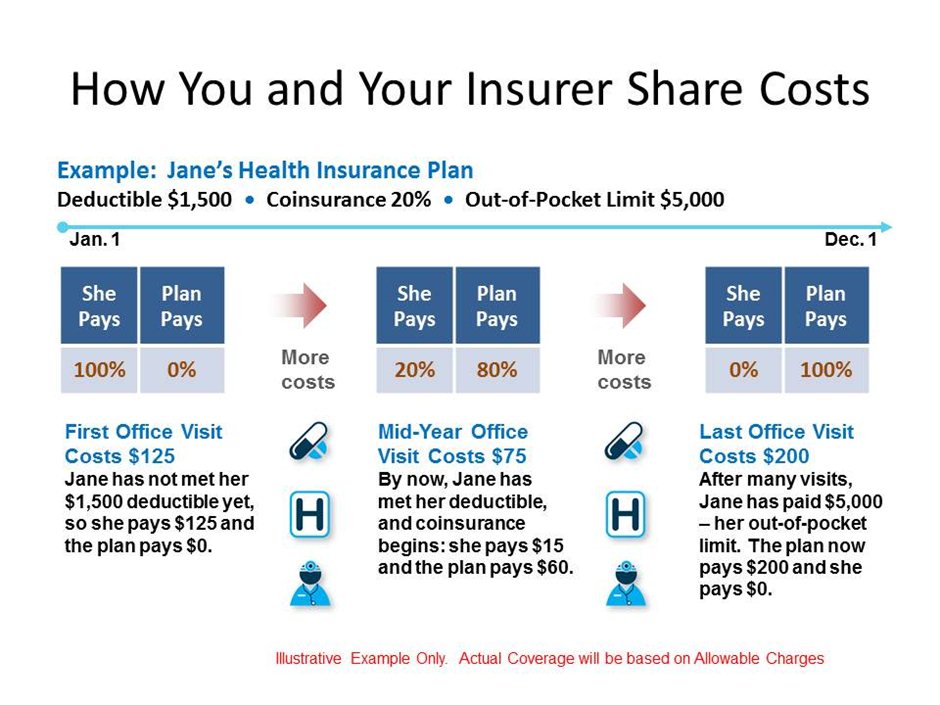

The insurer and the insured split medical costs typically with the insurer covering 80 of the cost while the insured covers 20 also known as 8020 coinsurance. A zero deductible plan means that you dont have to pay for any costs upfront before receiving your benefits.

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

What a Zero Deductible Insurance Policy Means.

0 coinsurance after deductible. What does 30 coinsurance mean. Coinsurance is often 10 30 or 20 percent. Some plans offer 0 coinsurance meaning youd have no coinsurance.

1800 - 2300 AZN Smarton MMC Bakı. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. Someone with 0 coinsurance doesnt have to pay any out-of-pocket costs once you reach the deductible.

Coinsurance is the percentage of your medical costs that you actually have to pay after reaching your deductible. For instance with 10 percent coinsurance and a 2000 deductible. An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance.

SATIŞ NÜMAYƏNDƏSİ 1 ildən 3 ilə. 0 0 does NOT 3000. This will continue until youve met your maximum out-of-pocket for the year.

When you incur health care costs from a medical procedure you have to pay out of pocket until you spend a certain amount known as your deductible. 0 coinsurance after deductible meaning 2021. Coinsurance is the percentage of covered medical expenses that you are required to pay after the deductible.

On most plans youll continue to have to pay coinsurance andor copays after youve met your deductible. Furthermore Out of Pocket usually is how much your maximum payment of the Co-Insurance. The deductible for this certain plan is 450.

Some policies have a 1000 9010 or 7030 split where the insurance company. Once you hit your deductible your insurance company starts splitting the cost of future care based on a set percentage of the costs. A deductible is the amount you have to pay in that year before your insurance company covers the costs stated in your plan.

MAĞAZA MENECERİNİN KÖMƏKÇİSİ 1 ildən 3 ilə qədər Ali. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met.

Your insurance company will cover your allowable claims right away. In some cases though you may end up paying copays and coinsurance because some plans might implement both. You might see this referred to as 8020 coinsurance.

It is your share of the medical costs which get paid after you have paid the deductible for your plan. PARFÜMERİYA ÜZRƏ MƏSLƏHƏT Çİ 1 ildən aşağı Fərq etmir. Coinsurance The percentage of additional medical expenses that the insured meets in addition to the deductible.

When you visit the doctor for. Lets say your health insurance plan has a 20 coinsurance requirement excluding additional copays. A plan with 0 coinsurance likely has high premiums deductible or copays to make up for not paying any coinsurance.

What Does No Charge After Deductible Mean. 55K views Sponsored by Kintsugi Hair. AUDİO VİDEO SİSTEMLƏRİ ÜZRƏ MÜHƏNDİS 5 ildən artıq Ali.

A plan member with a 1000 medical bill would be responsible for 300 in the above example. Trying to figure out which health plan to get through healthcaregov but Im having a hard time understanding what it means when it says 0 Coinsurance After Deductible or No Charge After Deductible when speaking of a normal doctor visit or a specialty doctor. If there is NO deductible AND NO coinsurance there is NO out of pocket.

No usually you either have a copay or a coinsurance percentage to pay after you have met your deductible. Things like copays and coinsurance. It means you are responsible for 0 of the out of pocket expenses after your deductible is met.

800 - 1500 AZN Sinteks Bakı. If you had a 10 coinsirance you would be responsible for 10 of the medical expenses after the deductible is met until you reach the out of pocket maximum not including copays and out of network expenses. 0 coinsurance is a rare thing in todays market of insurance but the more common amount is 10 to 50 coinsurance.

Once you have met your deductible for a 100 medical bill you would pay 20 and the insurance company would pay 80. If you have your primary care doctor. Health insurance companies usually use a combination of copayments and coinsurance to split costs with consumers.

The percentage that you pay is your coinsurance. Normally these plans charge higher premium than policies with deductibles and co-insurance. However this only means you.

However if you have a plan that includes no charge after deductible then youre insurance carrier will cover 100 of your costs after you reach your deductible. 250 - 300 AZN AzeriMed Bakı. With most health insurance plans once you hit your deductible youll still need to pay some out-of-pocket expenses.

I understand how a deductible and coinsurance. Yup in health insurance no-coinsurance plan may mean that you are not required to pay any out-of-pocket expense apart from the said deductible at the time of need. 0 coinsurance means that the moment you reach your deductible the insurance company will be bound to ay you 100 of the contracted amount for some of the services that they cover which include clinic visits and Rx that most commonly include co-payments but covered services also involve tests like MRI and procedures like that they all involve coinsurance.

What does a 0 deductible 0 coinsurance health insurance plan mean with a 3000 out of pocket maximum. Coinsurance is a percentage of a healthcare service that you will pay forFor example say you have a health insurance plan with no deductible but instead has a 20 coinsurance for all services. For example a doctors visit is a set 50 copay but emergency visit costs are covered at 70.