400 - 500 FPL. For the FY 2020 income limits the cap is almost 8 percent.

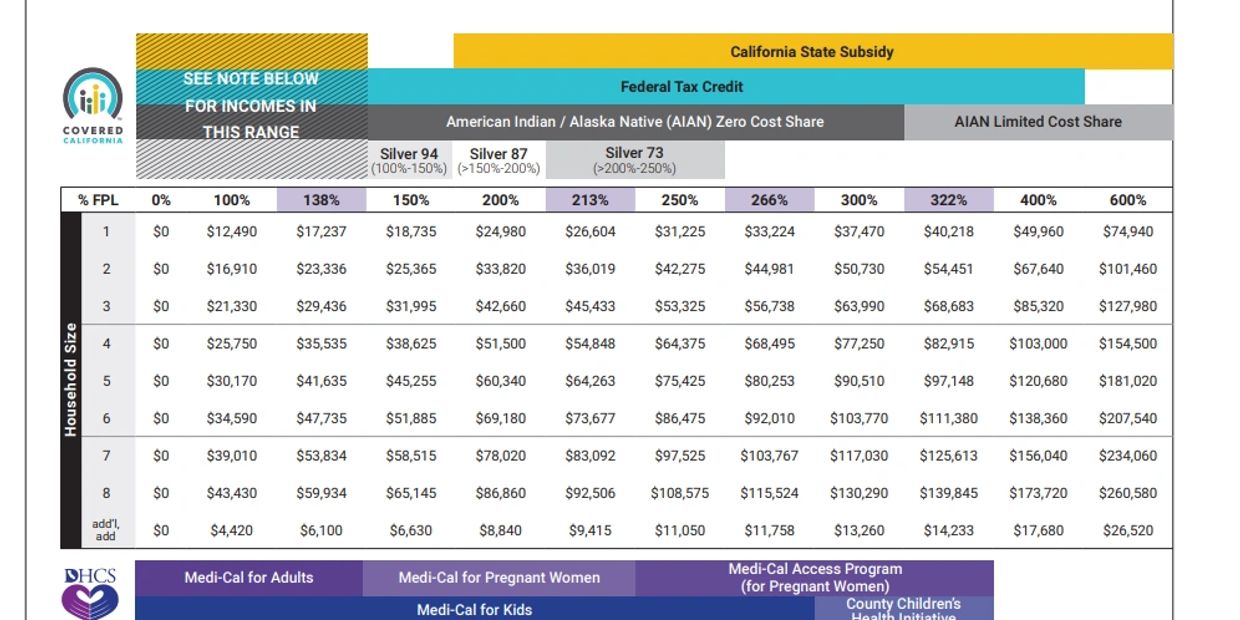

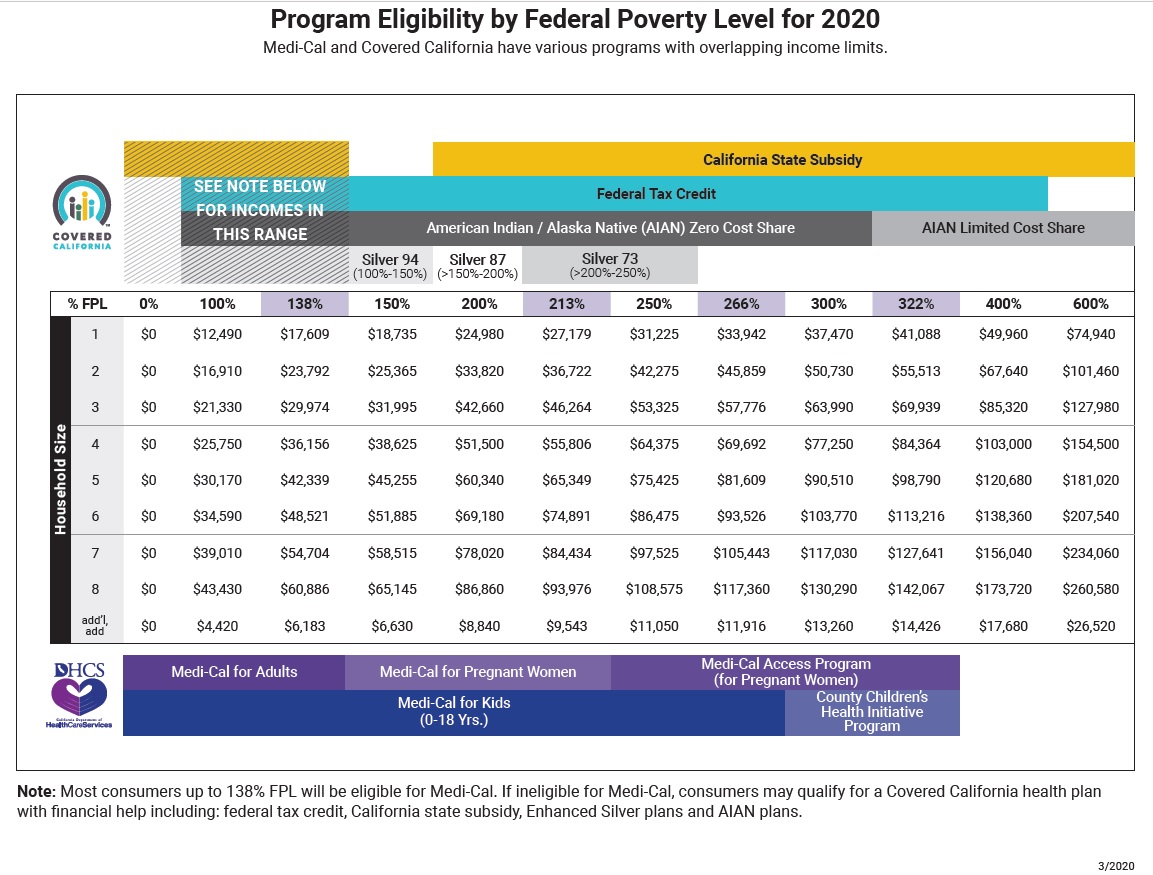

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

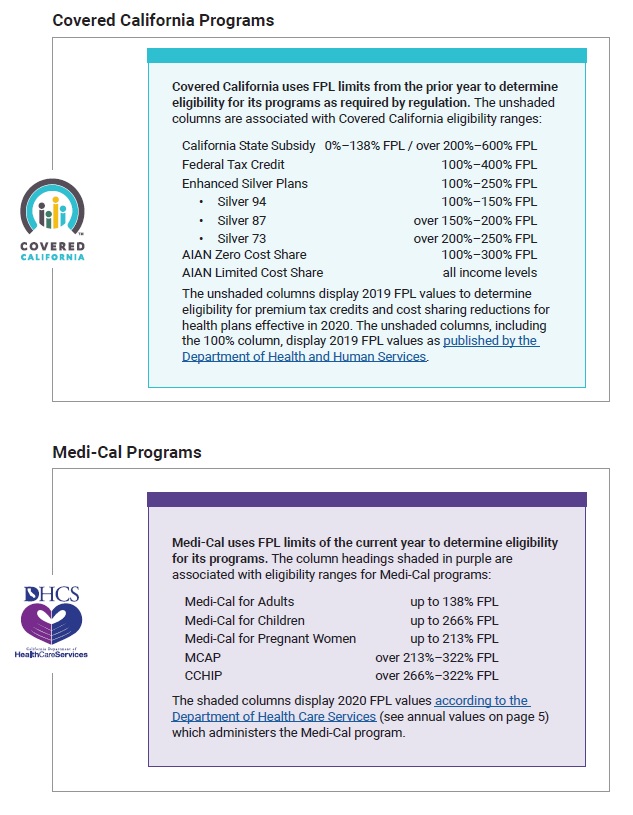

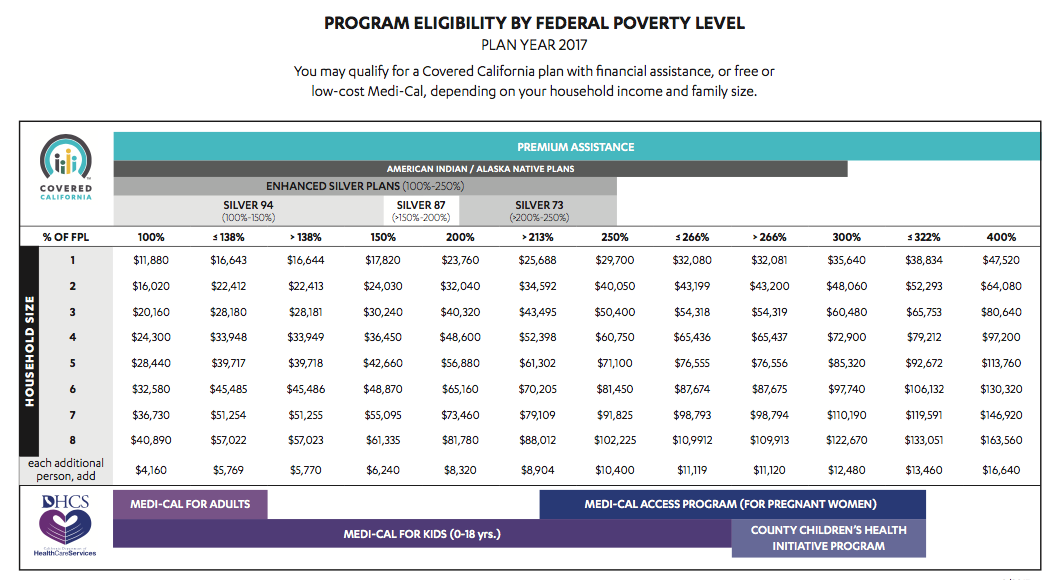

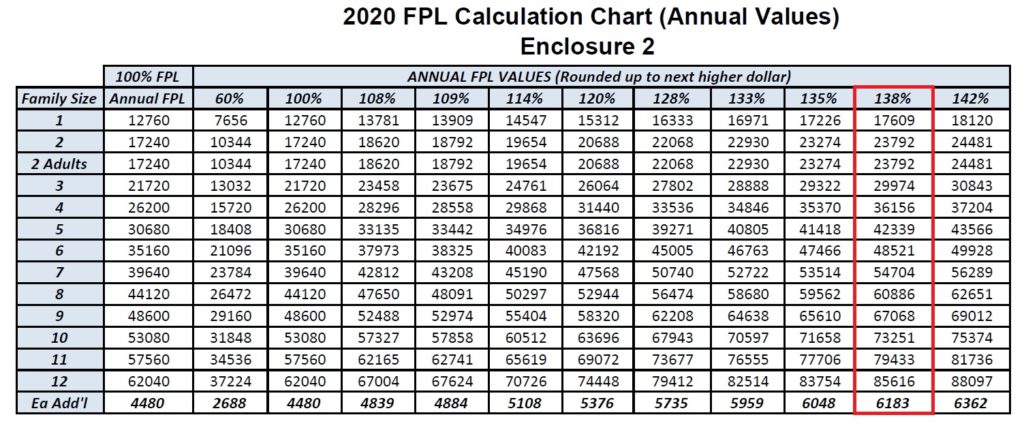

Most consumers up to 138 FPL will be eligible for Medi-Cal.

Covered ca income limits 2020. For areas where income limits are decreasing HUD limits the decrease to no more than 5 percent per year. The 2020 State Income Limits. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and 35535 for a family of four.

If you make 601. The subsidies are for individual Californians who earn. Attached are briefing materials and State Income Limits for 2020 that are now in effect and replace 2019 State Income Limits.

Program Eligibility by Federal Poverty Level for 2020 Medi-Cal and Covered California have various programs with overlapping income limits. California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040.

For example for a household at 500 of FPL the subsidy kicks in at 16 of your income. 2020 Income Limits PIS from 3-28-16 -- 4-13-17. 600 - 700 FPL.

Columns are associated with Covered California eligibility ranges. Exemptions Processed by Covered California. 300 - 400 FPL.

2020 Income Limits PIS from 4-1-18 - 4-23-19. 200 - 300 FPL. State Income Limits for 2020.

In 2020 those who make between 400 to 600 of the FPL are eligible for subsidies. April 15 2016 OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan. If your health insurance premiums are over 16 of income then the state of California will cover any additional costs through up-front subsidies.

Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable. However starting in 2020 in California those between 400 and 600 of FPL may qualify for state subsidies. Less than 200 FPL.

The new policy limits annual increases in income limits to 5 percent or twice the change in the national median family income whichever is greater. 2020 Income Limits PIS from 3-6-15 -- 3-27-16. Then add or subtract any income.

A full listing of exemptions can be found on the FTB website. 2020 Income Limits Post 4-1-20. Short coverage gap of 3 consecutive months or less.

In order to be eligible for assistance through Covered California you must meet an income requirement. Income limits reflect updated median income and household income levels for extremely low- very low- low- and moderate-income households for Californias 58 counties. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and35535 for a family of four.

500 - 600 FPL. This means that a family of four with an annual income of around 150000 per year may be eligible for subsidies. Add any foreign income Social Security benefits and interest that are tax-exempt.

Be claimed when filing 2020 state income tax returns in early 2021. Income is below the tax filing threshold. Covered California Outreach and Sales Division Updated.

2020 Income Limits PIS from 4-24-19 - 3-31-20. Because their benchmark plan costs more than their maximum contribution they would be eligible for 190 in State credit 1675-1485. Whether you qualify for financial assistance depends on your household income and family size.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple and 154500 for a family of. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Individual Minimum 750 wwwftbcagov Married Couple Minimum 1500 Family of 4 2 Children Minimum 2250 If you arent covered for most of the year in 2020 you could face a penalty at tax time. They will see their premiums for the benchmark plan lowered to 1 per member per month. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL AIAN Zero Cost Share 100300 FPL AIAN Limited Cost Share all income levels The unshaded columns display 2020 FPL values to determine.

2020 Income Limits PIS from 4-14-17 - 3-31-18. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan. State subsidies are designed largely to assist consumers who see their contribution amount skyrocket when they fall off the 400 cliff.

Certain non-citizens who are not lawfully present.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Income Limits Explained

Covered California Income Limits Explained

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.