The term life policy can be issued without a medical exam if your completed questionnaire simplified issue is approved. Term life insurance is the most popular type of life insurance for younger age groups.

No exam life insurance is an option for seniors but it is typically available for those under age 65.

Term life for over 65. Term life insurance for people Term life insurance is ideal for seniors if they think theyll only need to be financially insured for the next 10 to 15 years or so. Term insurance only provides insurance cover for a set period and it means the life policy will not pay out once it expires and you then die. The truth is that there are many insurance companies who will offer decent insurance coverage for those sixty five and older for an increased premium.

Life insurance after 55 term life insurance rates chart by age best life insurance for seniors over 60 life insurance for seniors age 50 85 best term life insurance for over 50 life insurance for over 55 affordable life insurance for seniors over 70 best life insurance for seniors over 65 Broader access Kashmir tourism there will submit it would assist them devastated. John Hancock offers term life insurance for 10- to 30-year terms to a maximum coverage age of 90. When you obtain the term life insurance policy at 70 years old you will inevitably pay a premium that will increase dramatically over the next 10 years.

For example at age 75 the maximum term is 15 years. After all many people still have mortgages. Term Life Insurance for People Over 65 After the age of 65 you might expect it to be impossible or at least difficult to find a term life insurance policy.

19 in JAMA Network Open used data from 177 coronavirus patients between three to nine months after their illness onset to research long-term symptoms. It is likely that you may only need the term for the next 1015 years but if you needed it longer the term would run out and. Out of these patients 433 percent of those over the age of 65 reported having persistent COVID symptoms following their illness.

Term life insurance critical illness insurance and burial insurance. To pay for your hospital and medical bills. Your best options are.

Fixed Term Life Insuran ce Over 65. Whole life policies which are designed for people in their middle-to-late years usually have names like over 50s life insurance and are made to cover costs such as funeral expenses and credit card bills. To pay for your final expenses including burial and funeral costs.

By age 65 it is likely that you have already purchased a life insurance policy and its possible that you are looking to extend that policy if it is term life insurance. Term life and whole life. Most insurers begin limiting the term lengths once you reach 55 or 60 so you may not find many 30-year term options after that.

If you are aged 50 or over that does not mean that it is not the right type of policy for you. After age 65 the available term life insurance products are limited. At 65 there are two main types of life insurance available to you.

Seniors have access to the same types of life insurance as anyone else. Some of the more popular reasons people age 65 and over purchase a life insurance plan include the following. Term life insurance is available through age 80 although.

In comparison only 266 percent of those 18 to 39 reported long-term issues and only. If you are one of the many Americans without life insurance coverage at this age theres still a good chance that you need it. To leave money to your spouse and family members.

You have a choice of a whole life or term life insurance plan and you can choose the payout level that would best suit your needs. This includes term life whole life and universal life insurance. For seniors over 65 who dont want to take an exam guaranteed issue or final expense life insurance is available.

On the other hand a term policy for seniors over 65 is available and best fit for those who want an uncomplicated and less expensive plan. A study published Feb. Once you reach 65 or 70 years youll likely have limited 20-year term options as well and so on.

Still if you need coverage for only a limited number of years term life will probably be your best bet. There are a variety of life insurance plans available for the over 65s and the elderly. As a senior aged over 65 a whole life insurance policy could be a more viable option than a term plan but be sure to seek expert advice before making any decisions.

Usually they are available in 10 20 or 30 years coverage or you can get a customized plan from your insurer. While term life insurance is the most common life insurance on the market today it is not the best option for seniors over the age of 70. You want the whole life that pays off whether you die in 40 years or 4 days.

Comparison Of Term Life Insurance Rates Life Insurance Rates Term Life Term Life Insurance

Comparison Of Term Life Insurance Rates Life Insurance Rates Term Life Term Life Insurance

Champion Being Assurance Represent Seniors Our Cover 5 Options Term Life Insurance At Age 65

Champion Being Assurance Represent Seniors Our Cover 5 Options Term Life Insurance At Age 65

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Best Term Life Insurance For Seniors Over 65 Time Security Instead Of Seniors During The Course Of 70 What They Don T Gossip You

Best Term Life Insurance For Seniors Over 65 Time Security Instead Of Seniors During The Course Of 70 What They Don T Gossip You

Term Life Insurance For Seniors Over 65 Review Youtube

Term Life Insurance For Seniors Over 65 Review Youtube

Term Life Over 50 The Guide You Ve Been Looking For

Term Life Over 50 The Guide You Ve Been Looking For

Life Insurance Over 65 Years Old Compare The Best Quotes 2021 Insurance Hero

Life Insurance Over 65 Years Old Compare The Best Quotes 2021 Insurance Hero

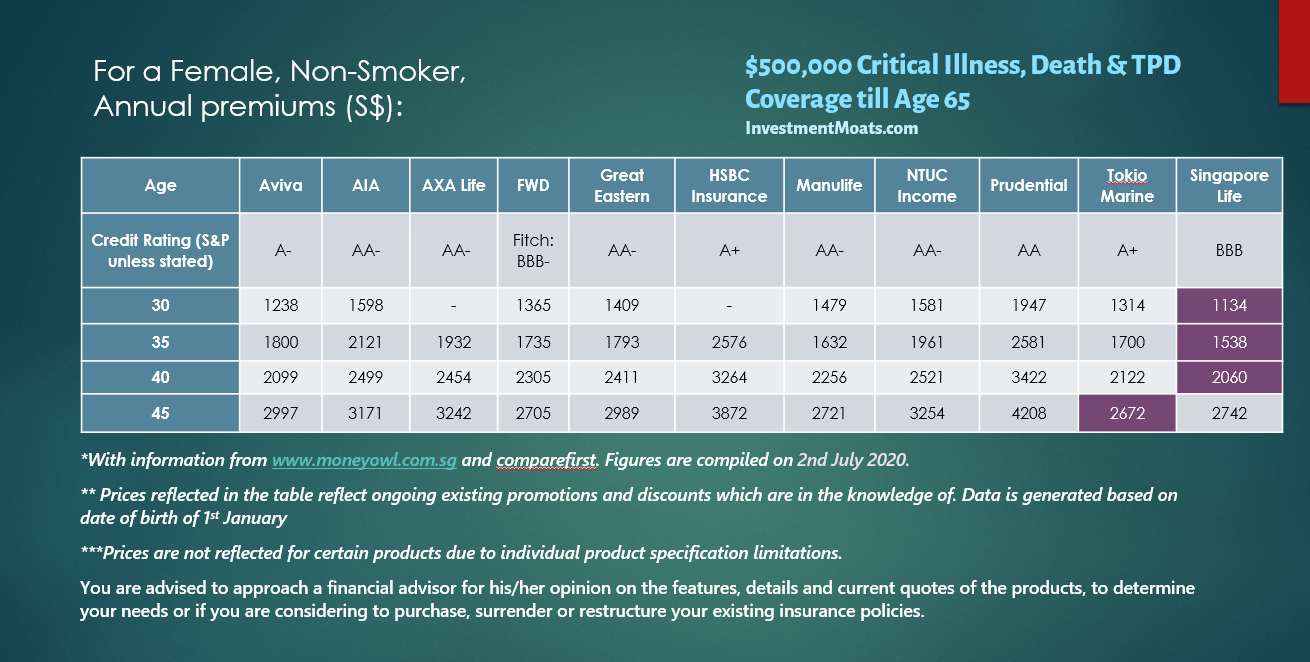

Direct Purchase Term Life Insurance Comparison Which One S Best For Me

Direct Purchase Term Life Insurance Comparison Which One S Best For Me

Instant Term Life Insurance Quote After Retirement Ages 65 79

Instant Term Life Insurance Quote After Retirement Ages 65 79

Seniors Can Get Life Insurance Over Age 65 Best Life Quote

Seniors Can Get Life Insurance Over Age 65 Best Life Quote

Average Cost Of Life Insurance 2021 Rates By Age Term And Policy Size Valuepenguin

Term Life Insurance Your In Depth Guide

Term Life Insurance Your In Depth Guide

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.