If a saver opts out they can later opt back into CalSavers. Saving through an IRA may not be appropriate for all individuals.

Calsavers Retirement Savings Program Napa Sonoma Sbdc

Calsavers Retirement Savings Program Napa Sonoma Sbdc

IRAs are not exclusive to CalSavers.

Cal saver program. These contributions are invested in default target date retirement funds unless the employee directs their investments otherwise. Employer facilitation of CalSavers should not be considered an endorsement or recommendation by a participating employer IRAs or. Learn how the CalSavers program works and how you can educate your clients about this fantastic new program.

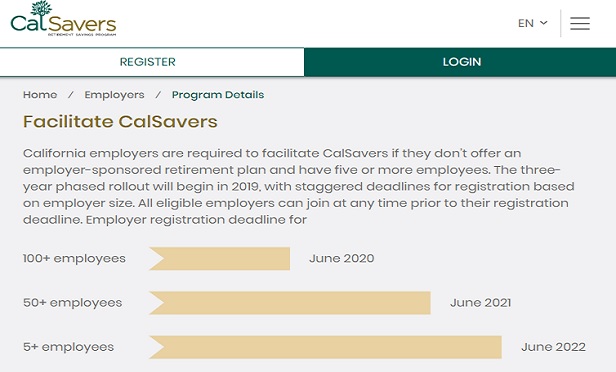

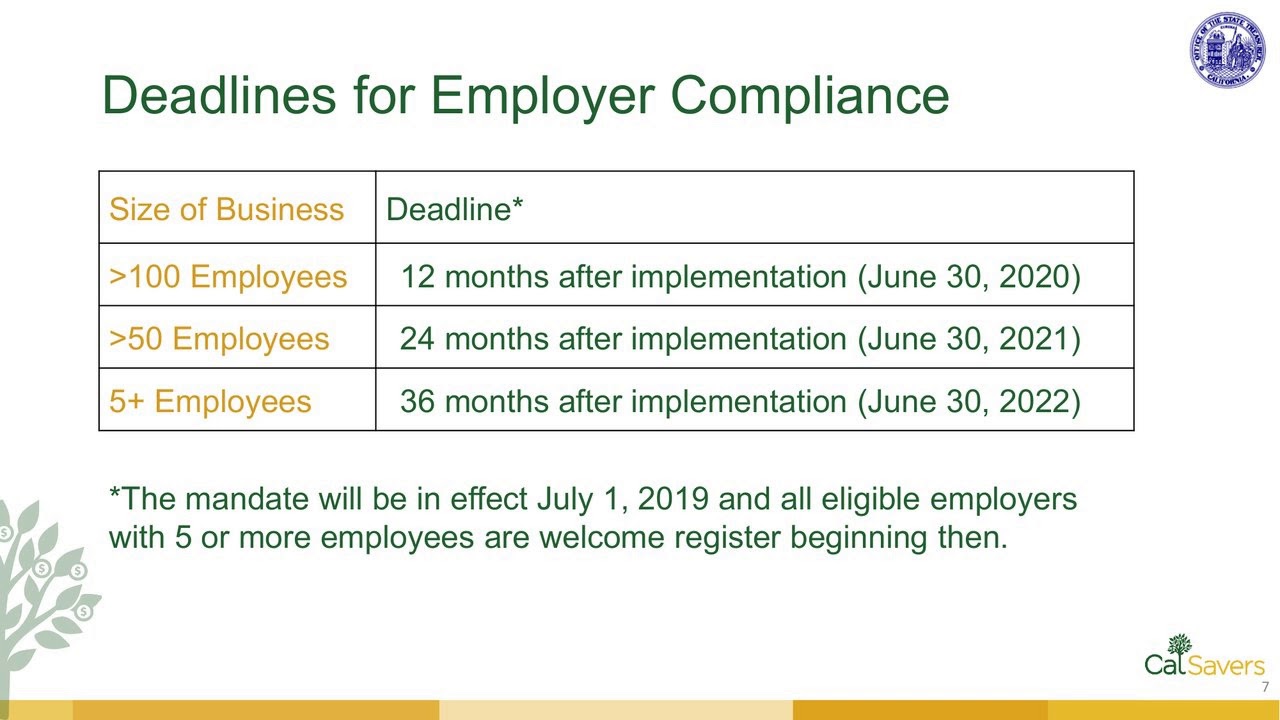

Are employers required to offer retirement plans. If a saver opts out they can later opt back into CalSavers. What began in 2018 as a pilot program CalSavers a state-sponsored retirement savings program that requires certain-sized businesses to offer employees the option of participating in a plan is now entering its second phase of a three-year tiered approach to registration.

An anti-tax group is. Employers with five or more employees are required to either provide a retirement plan for their workers or register for CalSavers. CalSavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan.

This program gives employers an easy way to help their employees save for retirement with no employer fees no fiduciary liability and minimal employer responsibilities. Vorschädigung Schneller Zugang zu Erythrozytenkonzen-trat mit maximalem Blutdurchatsz Waschfaktor 7 75 1 CATSmart Die Waschprogramme Sehr hoch. Currently businesses with more than 50 employees have until June 30 2021 to implement CalSavers or an equivalent qualified retirement program.

Employer facilitation of CalSavers should not be considered an endorsement or recommendation by a participating employer IRAs or the investment options offered through CalSavers. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Beginning July 1 2019 CalSavers Retirement Program became a new employment law in California.

CalSavers is Californias retirement savings program designed for the millions of Californians who lack a way to save for retirement at their job. The program which began as a pilot initiative in November 2018 officially opened for registration in July 2019. Employers with five or more employees must participate in.

CalSavers is a completely voluntary retirement program. Employer facilitation of CalSavers should not be considered an endorsement or recommendation by a participating employer IRAs or the investment options offered through CalSavers. Savers may opt out at any time or reduce or increase the amount of payroll contributions.

CalSavers is a completely voluntary retirement program. CalSavers was created by legislation passed in 2016 requiring California employers that do not sponsor a retirement plan to participate in CalSavers an automatic enrollment individual retirement. CalSavers is a state-run retirement savings program for private-sector workers whose employers do not offer a retirement program such as a 401k plan.

Depending on which investment options they select your employees will be required to pay an annual fee ranging from 0825 to 095. Programm Smart-Wash Programm Notfallwasch- programm Programm 25 Niedrig Normal Geschwindigkeit 40 Normal Qualität des Erythrozytenkonzentrates Einsatzbereich Kleine Blutverluste Blutverluste mit star-ker Verunreinigung bzw. Basically the program forces employers with more than 5 employees to defer a portion of their employees paychecks into a state run Roth IRA.

Saving through an IRA may not be appropriate for all individuals. The resulting program is known as CalSavers. If a saver opts out they can later opt back into CalSavers.

Jerry Brown signs legislation in 2016 creating CalSavers a retirement savings program for workers whose employers dont offer a pension or 401 k. Savers may opt out at any time or reduce or increase the amount of payroll contributions. CalSavers is a completely voluntary retirement program.

Wenn Sie Fragen zum Thema Qualität haben wenden Sie sich bitte an den. In July 2019 the state is launching a new retir. Qualität ist äußerst wichtig für uns.

Employer facilitation of CalSavers should not be considered an endorsement or recommendation by a participating employer IRAs or the investment options offered through CalSavers. The fee will be pulled directly from the assets in their Roth IRA. Saving through an IRA may not be appropriate for all individuals.

All employers will eventually be required to participate if they do not have or do not adopt an exempted retirement program. The California program is called CalSavers and is a state-mandated retirement savings plan with penalties for non-compliance. Your employees will pay administration fees to participate in the program.

Savers may opt out at any time or reduce or increase the amount of payroll contributions. CalSavers is completely free for employers. IRAs are not exclusive to CalSavers.

IRAs are not exclusive to CalSavers. CalSavers is a state-run Roth IRA program for California-based private-sector workers whose employers do not provide a retirement savings plan. Saving through an IRA may not be appropriate for all individuals.

CalSavers is a completely voluntary retirement program. If a saver opts out they can later opt back into CalSavers.

Https Www Treasurer Ca Gov Calsavers Meeting 2020 20200415 Staff 4 1 Pdf

Calsavers Everything You Need To Know Colony West

Calsavers Everything You Need To Know Colony West

Everything You Need To Know About Calsavers California S State Run Retirement Program Pai Com

Everything You Need To Know About Calsavers California S State Run Retirement Program Pai Com

Http Ocahu Org Resources Documents Cal 20savers 20 20ocahu 20presentation 20slides 20march 202020 Pdf

What You Have To Know About Calsavers No Matter Where You Live Thinkadvisor

What You Have To Know About Calsavers No Matter Where You Live Thinkadvisor

What People Are Saying Calsavers

What People Are Saying Calsavers

Calsavers California S Free Retirement Program Youtube

Calsavers California S Free Retirement Program Youtube

Saver Program Details Calsavers

Saver Program Details Calsavers

Calsavers A Simple Trusted Way To Save For Retirement

Calsavers A Simple Trusted Way To Save For Retirement

![]() Calsavers A Simple Trusted Way To Save For Retirement

Calsavers A Simple Trusted Way To Save For Retirement

Calsavers Retirement Savings Program What Employers Need To Know Ask Gusto

Calsavers Retirement Savings Program What Employers Need To Know Ask Gusto

California State Treasurer Calsavers Retirement Savings Program

California State Treasurer Calsavers Retirement Savings Program

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.