You pay more if you use doctors hospitals and providers outside of the network. If you choose to see a provider outside your plan your costs may be higher.

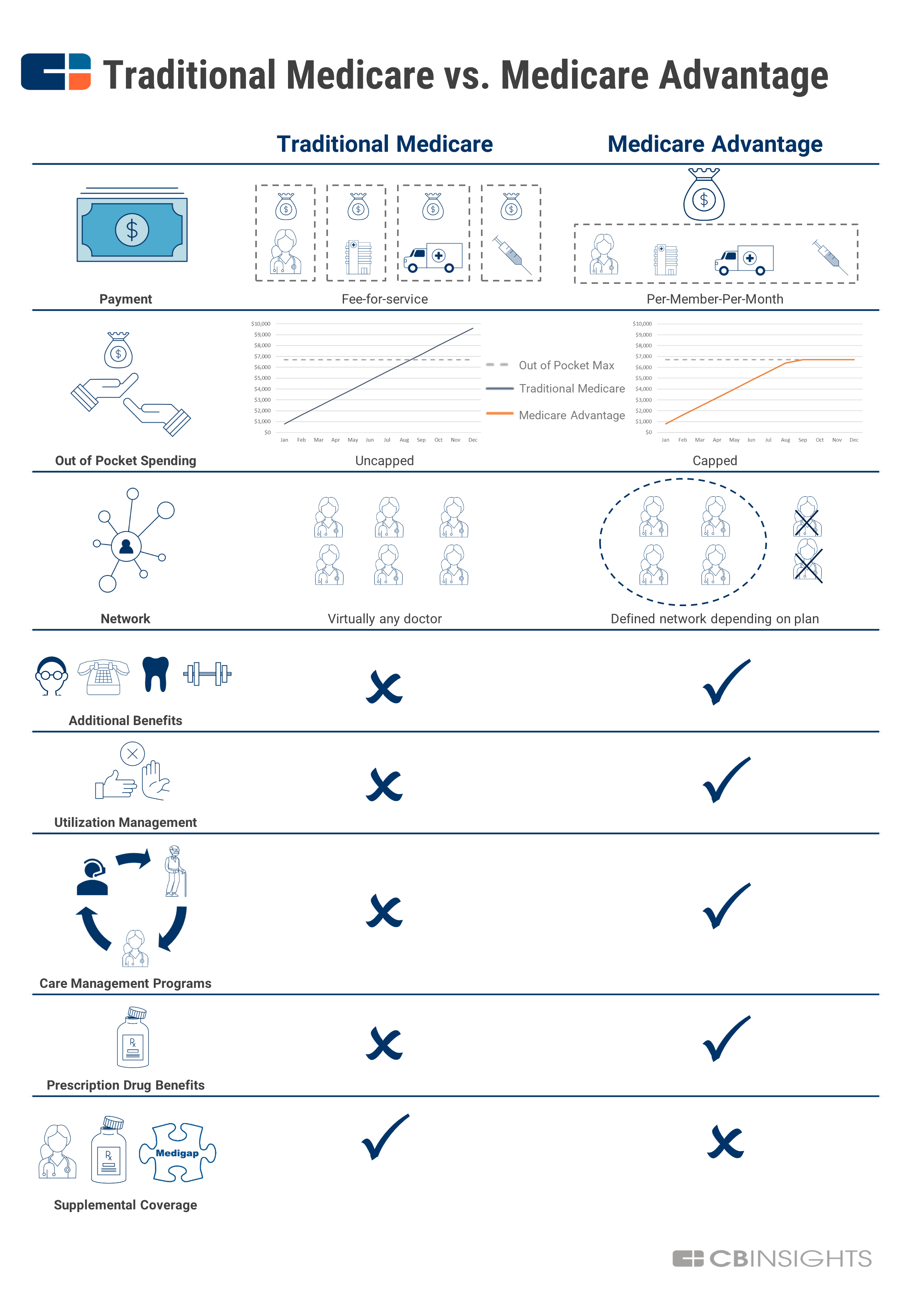

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

Generally if you have an HMO plan you pay less if you get care from a network Medicare doctor.

Medicare advantage ppo out of network. PPOs typically set fixed copays for in-network services and may charge more if you see an out-of-network provider. Out-of-networknoncontracted providers are under no obligation to treat Advantage U members except in emergency situations. PPO and PFFs have more relaxed regulations on networks.

Unlike Medicare Advantage plans traditional Medicare doesnt have provider networks. You pay less if you use doctors hospitals and other health care providers that belong to the plans Network. Please call our customer service number or see your Evidence of Coverage for more information including the cost- sharing that applies to out-of-network services.

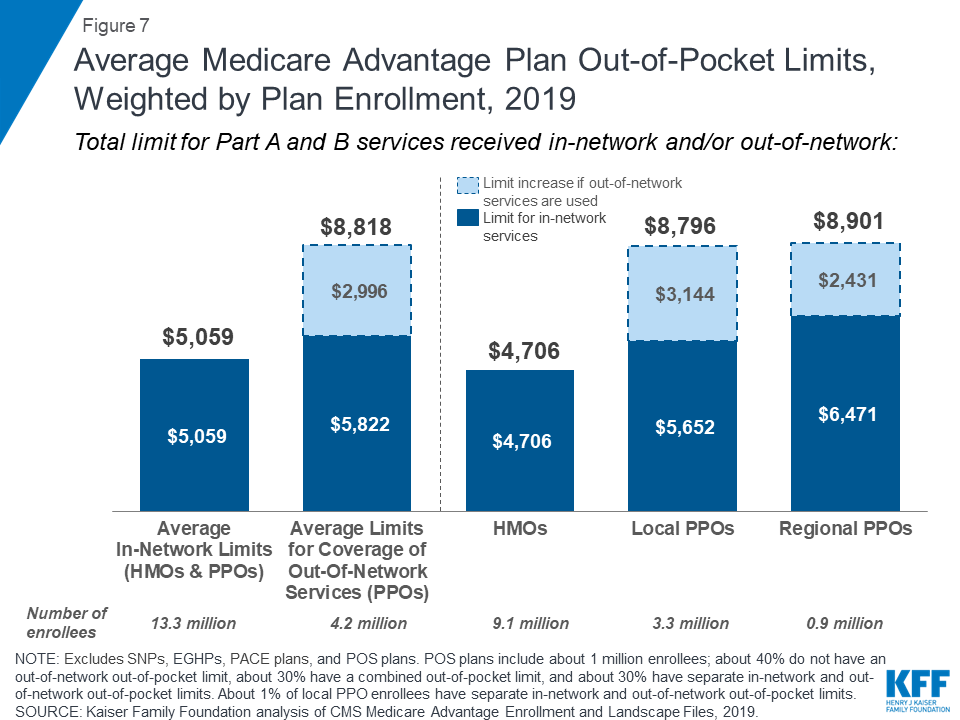

PPOs set two annual limits on your out-of-pocket costs. Yes-40 coinsurance per item. Medicare Advantage PPO Network Sharing Provides In-Network Access to Out-Of-Area Blue Plan Medicare Advantage PPO Members All Blue Cross andor Blue Shield Medicare Advantage PPO Plans participate in reciprocal network sharing.

Anthem MediBlue PPO is a Medicare Advantage plan that gives you the flexibility to work with any doctor or specialist in or out of network no referrals needed. Advantage U is a PPO with a Medicare contract. This means that the premiums and out of pocket costs for Medicare Advantage PPO plans may vary.

This is called an HMO with a point-of-service POS option. Preferred Provider Organization PPO plans have networks but you can you generally get care from any Medicare doctor. There are two PPO types Local PPO and Regional PPO.

In some plans you may be able to go out-of-network for certain services. Durable medical equipment eg wheelchairs oxygen-Out-of-Network. This document is a general outline of Medicare.

Prosthetics eg braces artificial limbs-Out-of-Network. Yes-50 coinsurance per item. A Special Needs plan SNP is like an HMO in the way that you can only go out of network for emergency and urgent care or if you traveling and need out-of-are dialysis.

PPO or Preferred Provider Organization plans are Medicare plans where you dont need to choose a primary care doctor and can utilize healthcare providers inside or outside your network. At the most basic level when a Medicare Advantage HMO member willingly seeks care from an out-of-network provider the member assumes full liability for payment. Preferred Provider Organization PPO Plans.

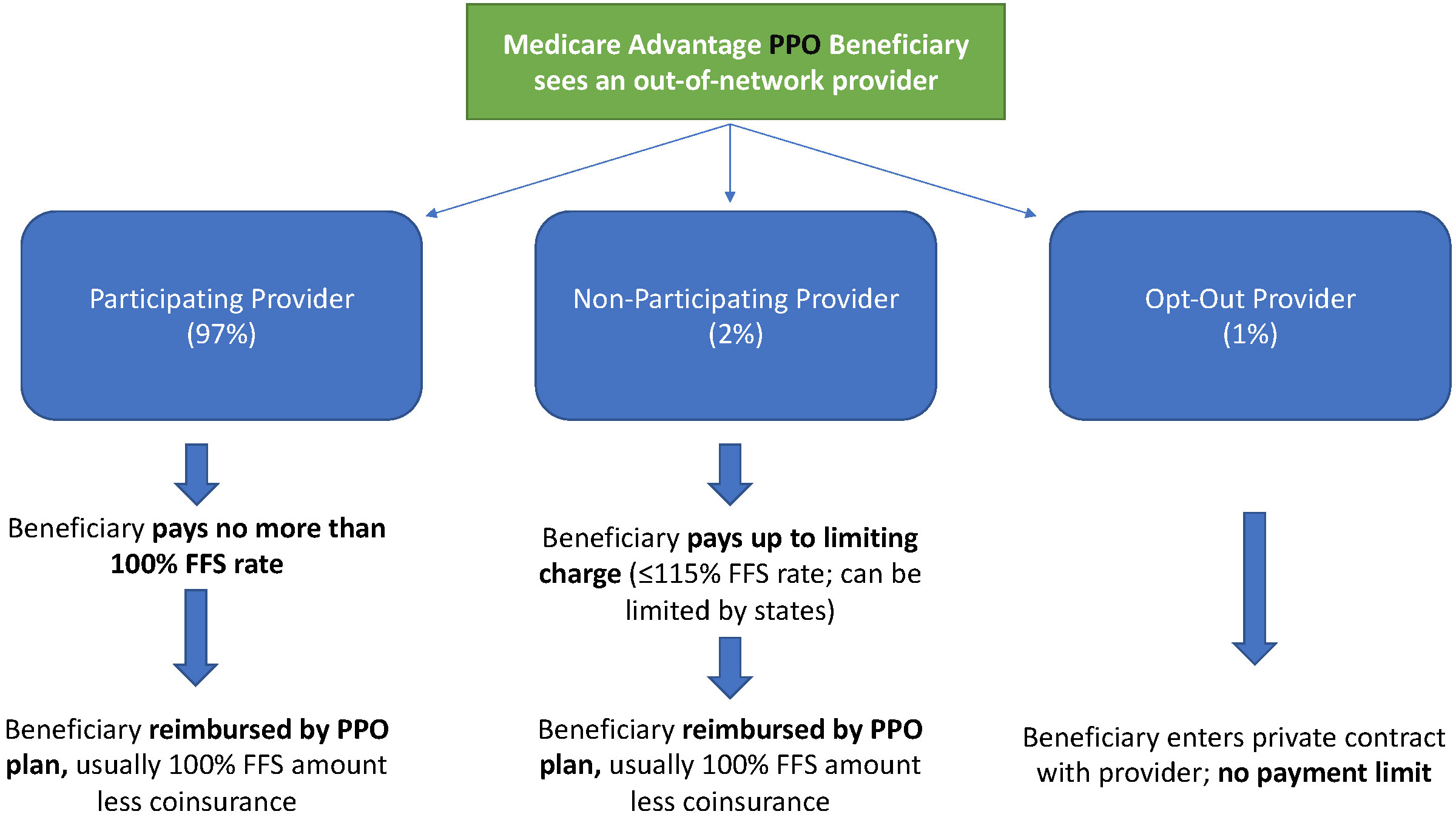

The basic Medicare Advantage out-of-network payment rule is that health care providers who treat Medicare Advantage enrollees on an out-of-network basis must accept as payment in full amounts the provider would have collected if the patient were enrolled in original Medicare. PPO Plans have network doctors other health care providers and hospitals. A Medicare Advantage PPO plan is a Part C plan that works like a Preferred Provider Organization PPO plan.

With PPOs youll pay less for using an in-network provider but out-of-network providers are also covered. Allows you to consult any health care provider but you typically need to pay more when seeing the out-of-network providers. 6 rows All Medicare Advantage plans have an out-of-pocket maximum amount that you will pay before.

Customers are not limited to their home service area for routine care. Gives you the advantage of consulting any health care provider and using any health care facility that accepts Medicare plans. Medicare Advantage plans are sold by private insurance companies.

That is neither the HMO plan nor TM will pay for services when an MA member goes out-of-network. Cigna Medicare Advantage Preferred Provider Organization PPO Plan. Generally customers are not req uired to select a PCP and referrals are never required to see Medicare-accepting providers in or out of the network.

One limit is for in-network costs and the other is for combined in-network and out-of-network costs. MA Payment Guide for Out of Network Payments 4152015 Update This is a guide to help MA and other Part C organizations in situations where they are required to pay at least the original Medicare rate to out of network providers. These limits may protect you from excessive costs if you need a lot of care or expensive treatments.

Refer to the 2021 ID Card section to identify customers. Original Medicare is from the government. A Medicare PPO Plan is a type of Medicare Advantage Plan Part C offered by a private insurance company.

Butit usually costs less if you get your care from a network provider. Yes-40 coinsurance per item. Allows you to only consult providers in the network.

Enrollment in Advantage U depends on contract renewal. Medicare Advantage PPO plans also known as Preferred Provider Organization plans have a network of providers such as doctors that costs less than other out-of-network providers.

What Is Medicare Advantage Ppo Vs Medicare Supplement Medicarequick

What Is Medicare Advantage Ppo Vs Medicare Supplement Medicarequick

Best Medicare Advantage Plans 2021

Best Medicare Advantage Plans 2021

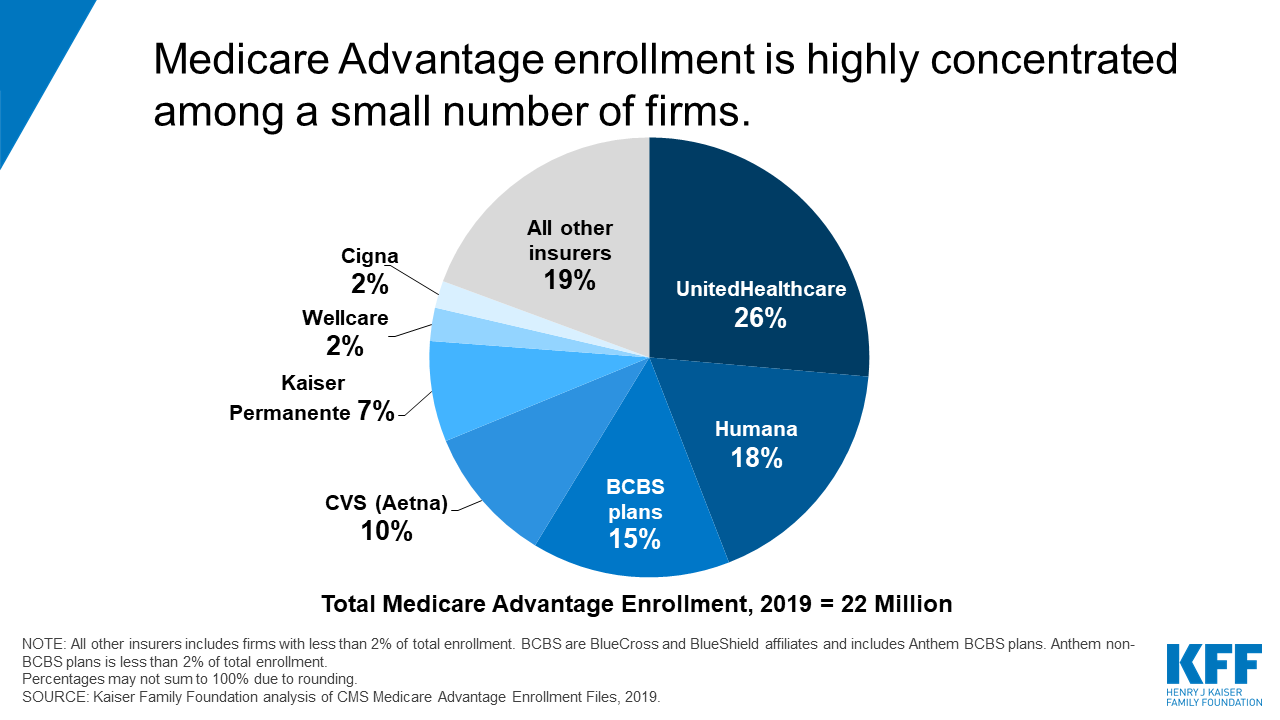

A Dozen Facts About Medicare Advantage In 2019 Kff

A Dozen Facts About Medicare Advantage In 2019 Kff

Are Medicare Advantage Plans Worth The Risk

Are Medicare Advantage Plans Worth The Risk

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Medicare Ppo Plan Medicare Advantage Ppo Medicare Ppo Plans

Medicare Ppo Plan Medicare Advantage Ppo Medicare Ppo Plans

A Dozen Facts About Medicare Advantage In 2019 Kff

A Dozen Facts About Medicare Advantage In 2019 Kff

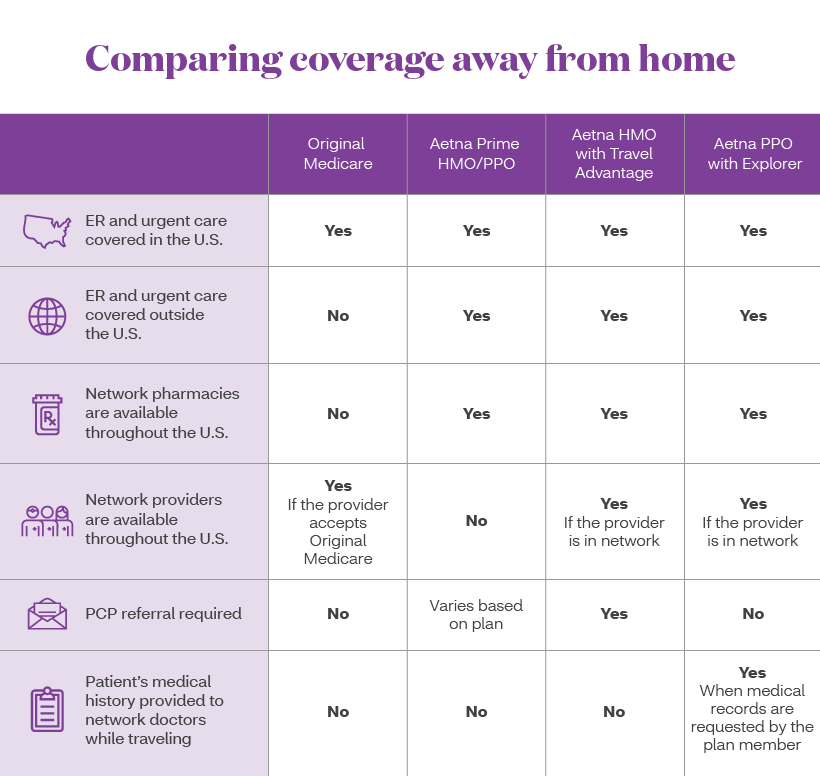

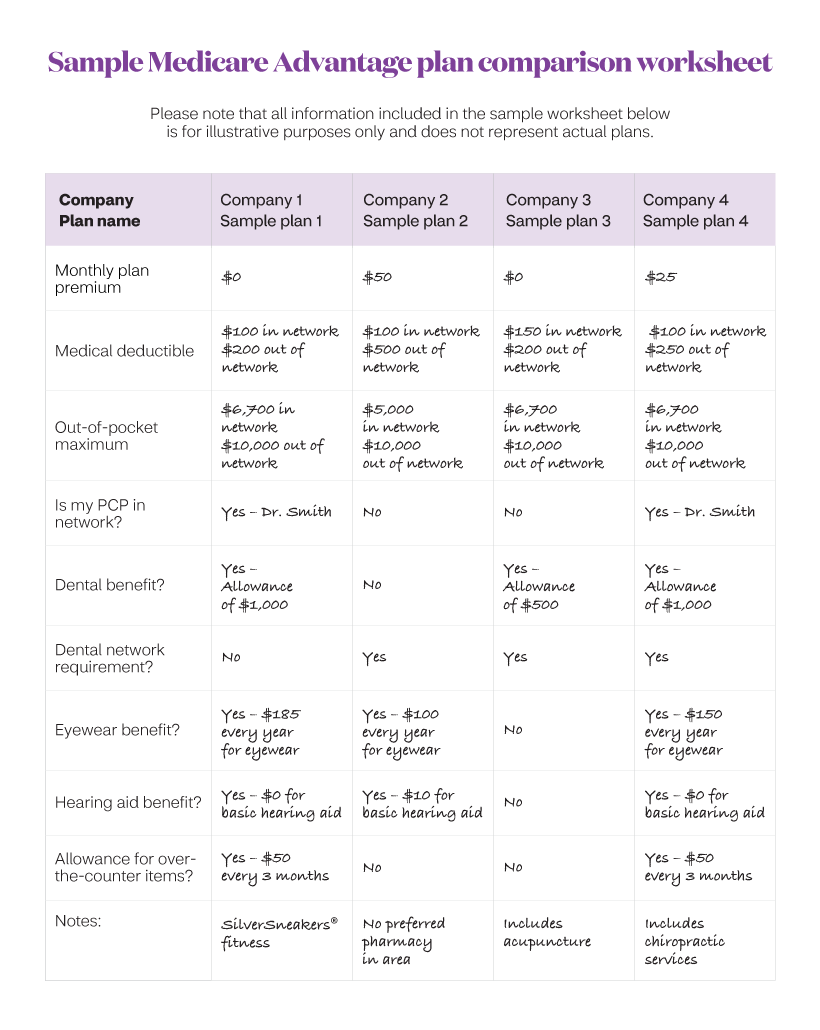

Comparing Medicare Advantage Plans Aetna

Comparing Medicare Advantage Plans Aetna

Out Of Network Payments In Medicare Advantage The Incidental Economist

Out Of Network Payments In Medicare Advantage The Incidental Economist

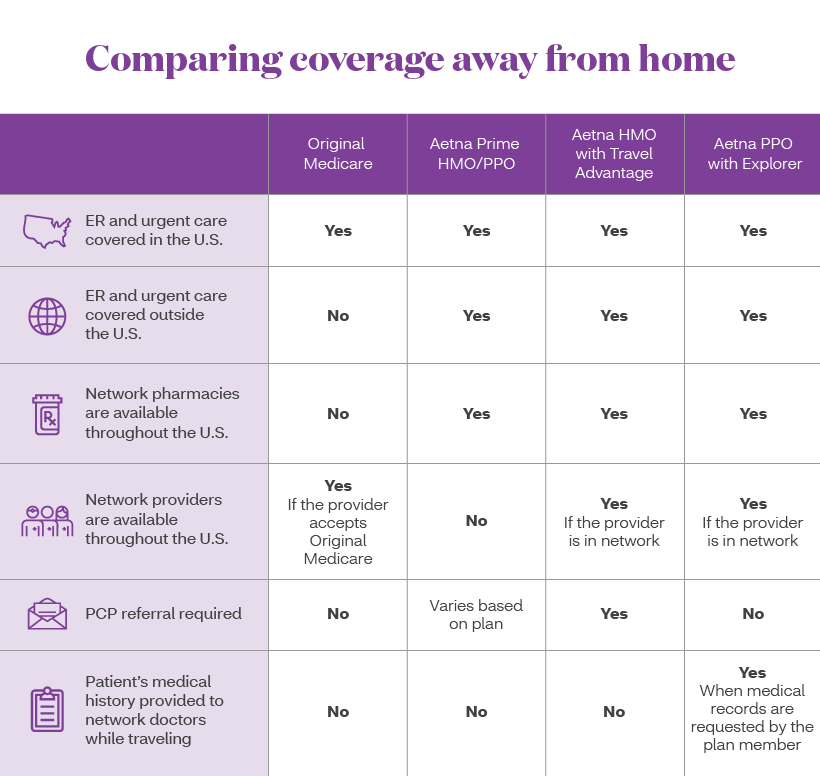

The Right Medicare Coverage For Travelers Aetna

The Right Medicare Coverage For Travelers Aetna

Braden Msi Insurance Medicare Advantage Plans Medicare Part C Braden Msi Insurance

Braden Msi Insurance Medicare Advantage Plans Medicare Part C Braden Msi Insurance

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Programs Types Of Medicare Advantage Plans

Medicare Advantage Programs Types Of Medicare Advantage Plans

Medicare Advantage Insurance Agency For Seniors

Medicare Advantage Insurance Agency For Seniors

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.