People can go to Medicaregov and search for a Medicare plan to find out more about estimated costs. 1484 deductible for each benefit period.

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

2 Plan K has an out-of-pocket yearly limit of 6220 in 2021.

Medicare out of pocket costs. The maximum deductible a plan can charge for 2021 is set at 445 2 an increase of 10 from 2020. Medicare Advantage plans and some Medicare Supplement insurance plans have out-of-pocket maximum limits. Average out-of-pocket costs are approximately 1600 per year and the average annual Medigap premium is approximately 2100 implying mark-ups of 31 percent.

Costs for Medicare health plans. Consider this example. Each plan determines its maximum out-of-pocket limit and can opt to offer a lower limit.

About 25 percent of Medicare beneficiaries purchase these plans from large private insurers such as UnitedHealth Aetna or BlueCross BlueShield. After you pay the out-of-pocket yearly limit and yearly Part B deductible it pays 100 of covered services for the rest of the calendar year. Your plan may or may not have a deductible.

Original Medicare doesnt have an out-of-pocket annual maximum limit. In 2020 this out-of-pocket limit is at most 6700 for every Medicare Advantage plan. Out of pocket costs are also called gap or patient payments.

If you live in Youngstown Ohio are in good health enroll in original Medicare and buy a Medicare supplement or Medigap policy and a Part D prescription drug plan all with mid-priced premiums CMS estimates that youll pay 5569 out. A Journal of the American Medical Association Oncology study published in 2016 looked at the out-of-pocket costs Medicare beneficiaries diagnosed with cancer between 2002 and 2012 spent. Medicare Supplement Medigap plans can pay for your Medicare out-of.

In 2019 the average out-of-pocket limit was about 5000 for in. Original Medicare Medicare Part A and Part B covers some hospital and medical costs but youre responsible for certain out-of-pocket costs such as deductibles copayments and coinsurance. Heres what you can expect to pay for Medicare out of pocket.

How much Medicare Part B medical insurance costs including Income Related Monthly Adjustment Amount IRMAA and late enrollment penalty. Original Medicare has no. Medicare Part D Out-of-pocket Costs.

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan Part C. After a person has paid this much in deductibles copayments and coinsurance the plan pays 100 of the costs. If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259.

The maximum amount you must pay out of your own pocket each year before your Medicare plan pays 100 of your covered health-care expenses. 3 Plan L has an out-of-pocket yearly limit of 3110 in 2021. If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471.

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. The next section explains Medicare drug plan cost-sharing in more detail. Most Medicare Advantage plans also include a drug component which may have its own deductible and cost-sharing amounts.

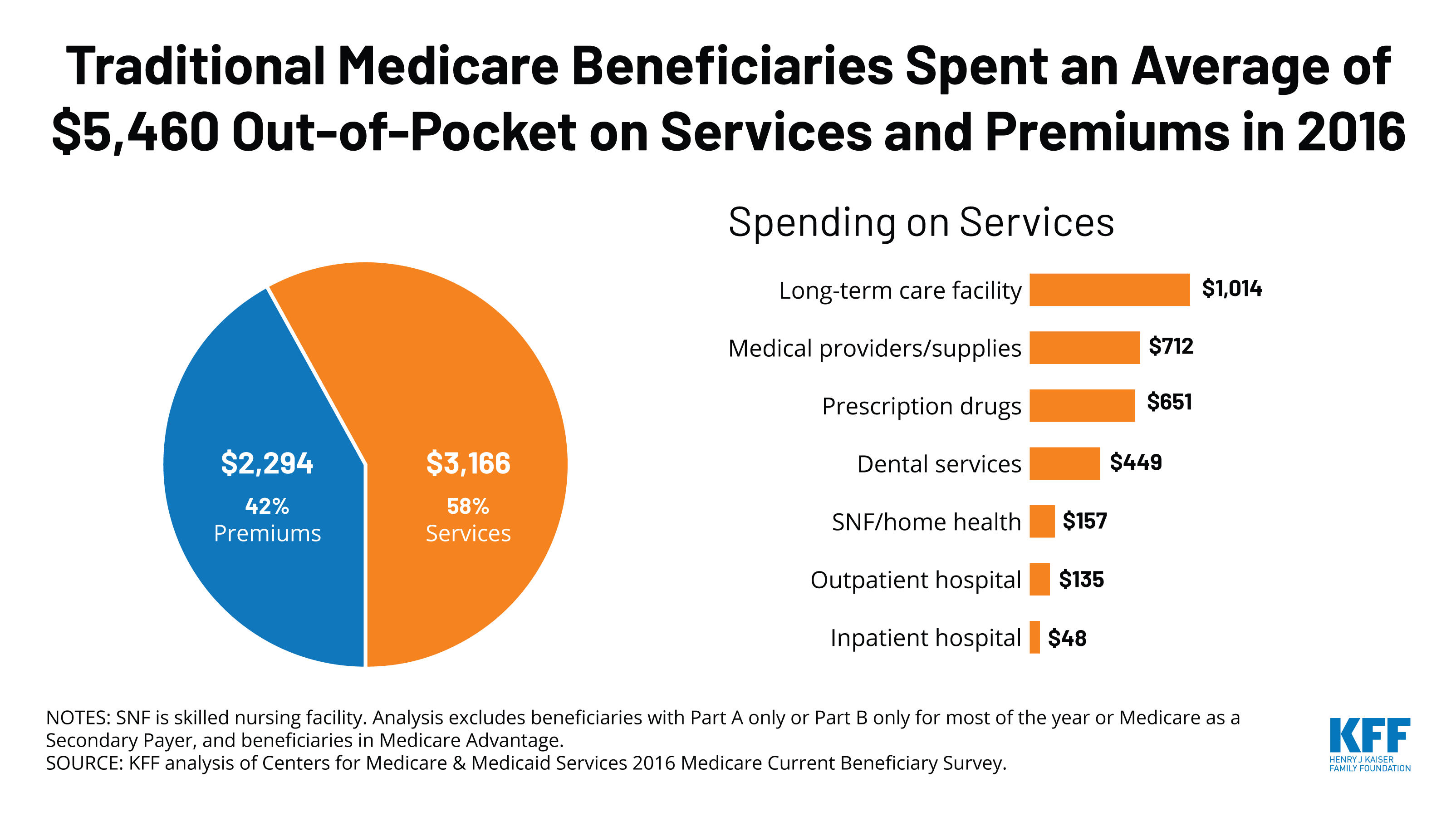

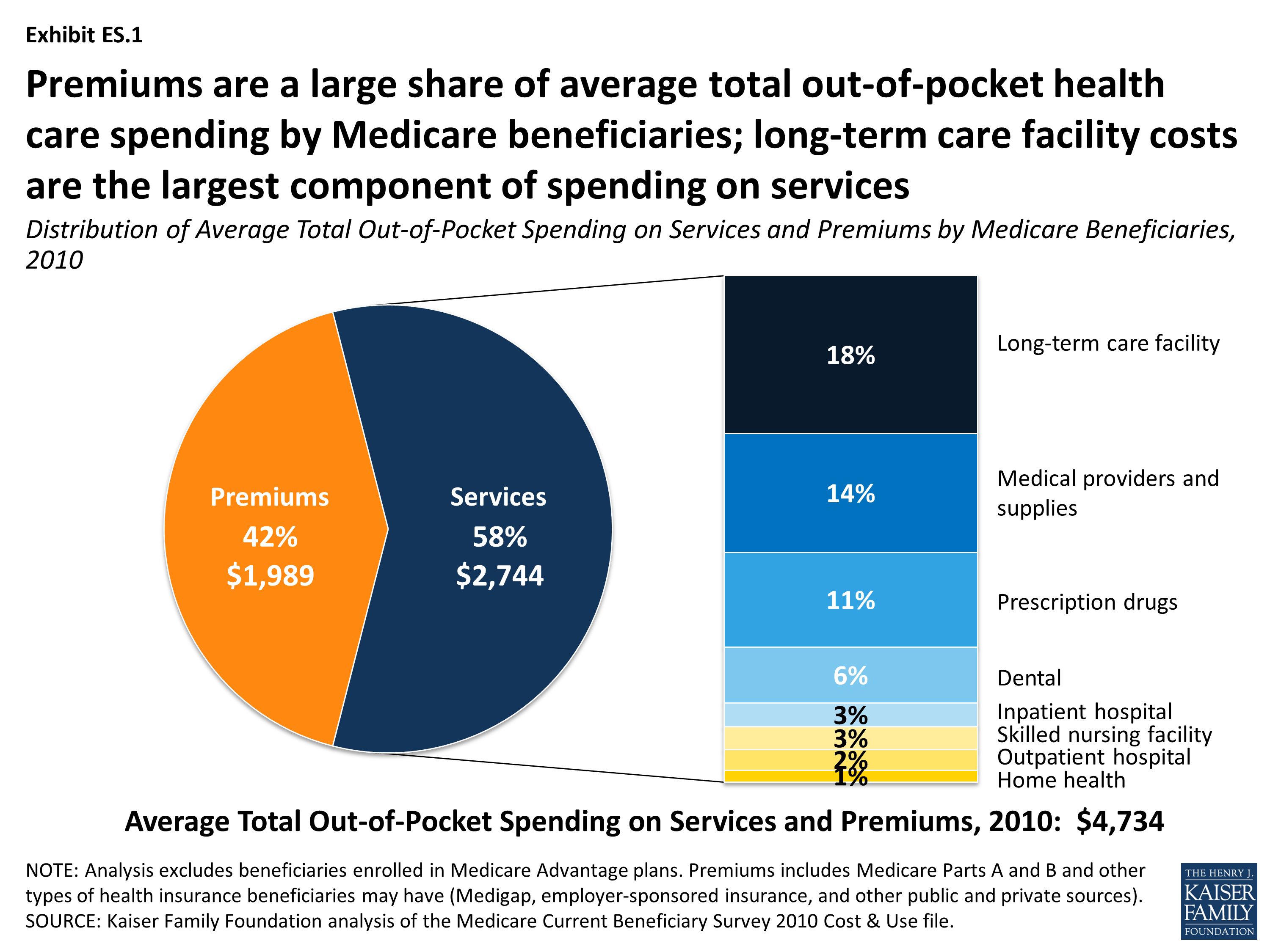

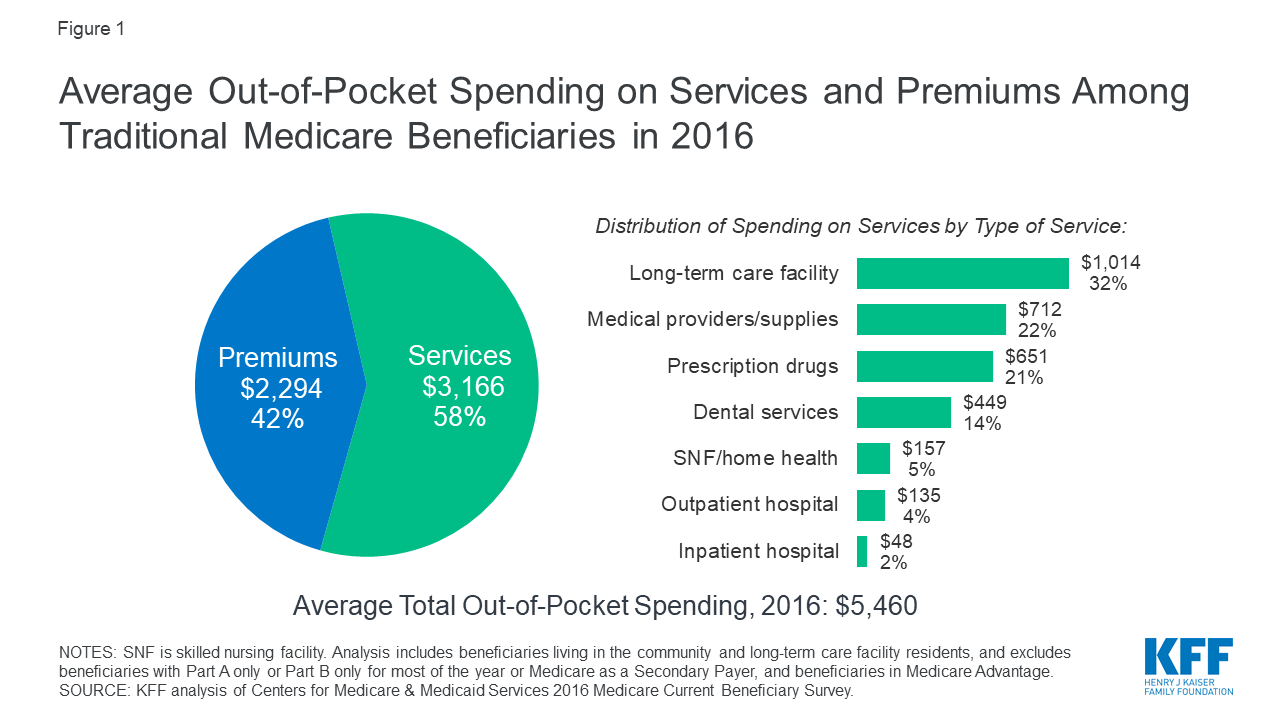

4 rows Here is a breakdown of what cost-sharing looks like in Medicare Advantage plans. Our analysis shows that Medicare beneficiaries spent 5460 out of their own pockets for health care in 2016 on average with more than half 58 spent on medical and long-term care services. Part A hospital inpatient deductible and coinsurance.

An out of pocket cost is the difference between the amount a doctor charges for a medical service and what Medicare and any private health insurer pays. The study found that those in a Medicare Advantage health maintenance organization HMO plan on average spent 5976 a year out of pocket for healthcare. However a base premium applies to Medicare Part D as well as to Medicare Advantage.

If you buy Part A youll pay up to 471 each month in 2021. Out of pocket costs. Medical services that arent covered.

The maximum out-of-pocket limit in 2021 is 7550.

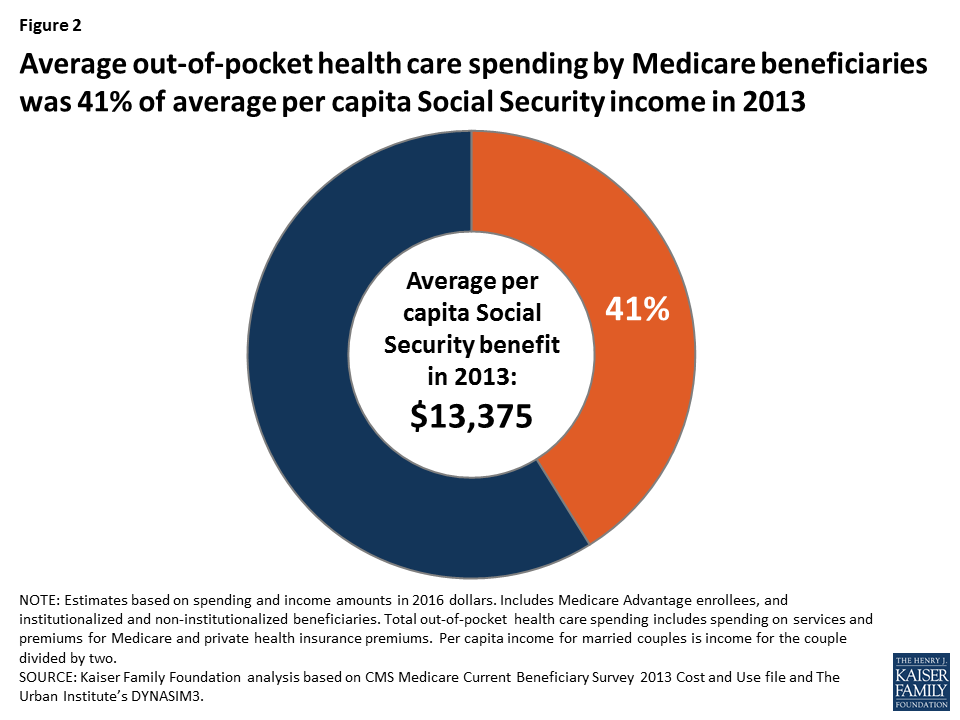

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

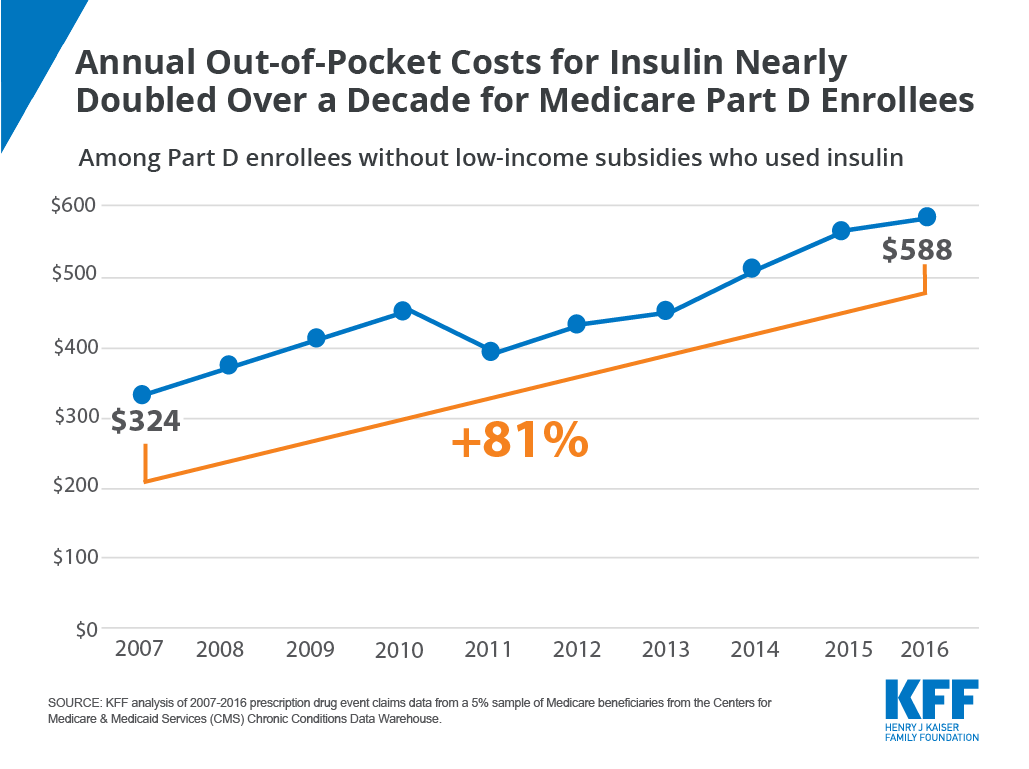

Annual Out Of Pocket Costs For Insulin Nearly Doubled Over A Decade For Medicare Part D Enrollees Kff

Annual Out Of Pocket Costs For Insulin Nearly Doubled Over A Decade For Medicare Part D Enrollees Kff

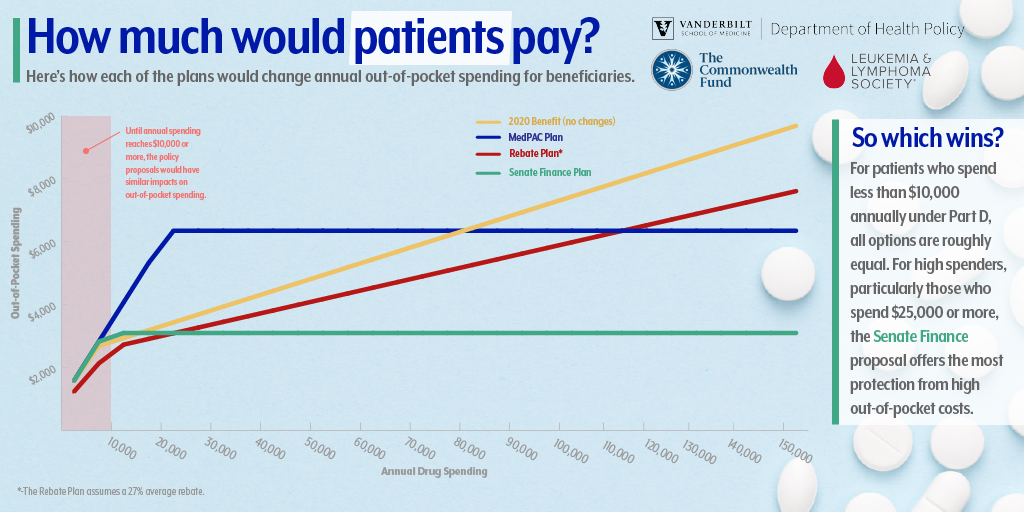

What Plan To Fix Medicare Part D Right Now Is Best Department Of Health Policy

What Plan To Fix Medicare Part D Right Now Is Best Department Of Health Policy

How Much Is Enough Out Of Pocket Spending Among Medicare Beneficiaries A Chartbook Kff

How Much Is Enough Out Of Pocket Spending Among Medicare Beneficiaries A Chartbook Kff

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

Estimated Average Out Of Pocket Spending For Skilled Facility Care Download Scientific Diagram

Estimated Average Out Of Pocket Spending For Skilled Facility Care Download Scientific Diagram

How Much Will I Pay In Medicare Part D Costs

How Much Will I Pay In Medicare Part D Costs

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Out Of Pocket Costs You Should Expect To Pay Medicare Us News

Medicare Out Of Pocket Costs You Should Expect To Pay Medicare Us News

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

2020 Medicare Prices And Out Of Pocket Costs Plan Prescriber

2020 Medicare Prices And Out Of Pocket Costs Plan Prescriber

Medicare Advantage Out Of Pocket Maximum What You Need To Know

Medicare Advantage Out Of Pocket Maximum What You Need To Know

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Report 9129 Kff

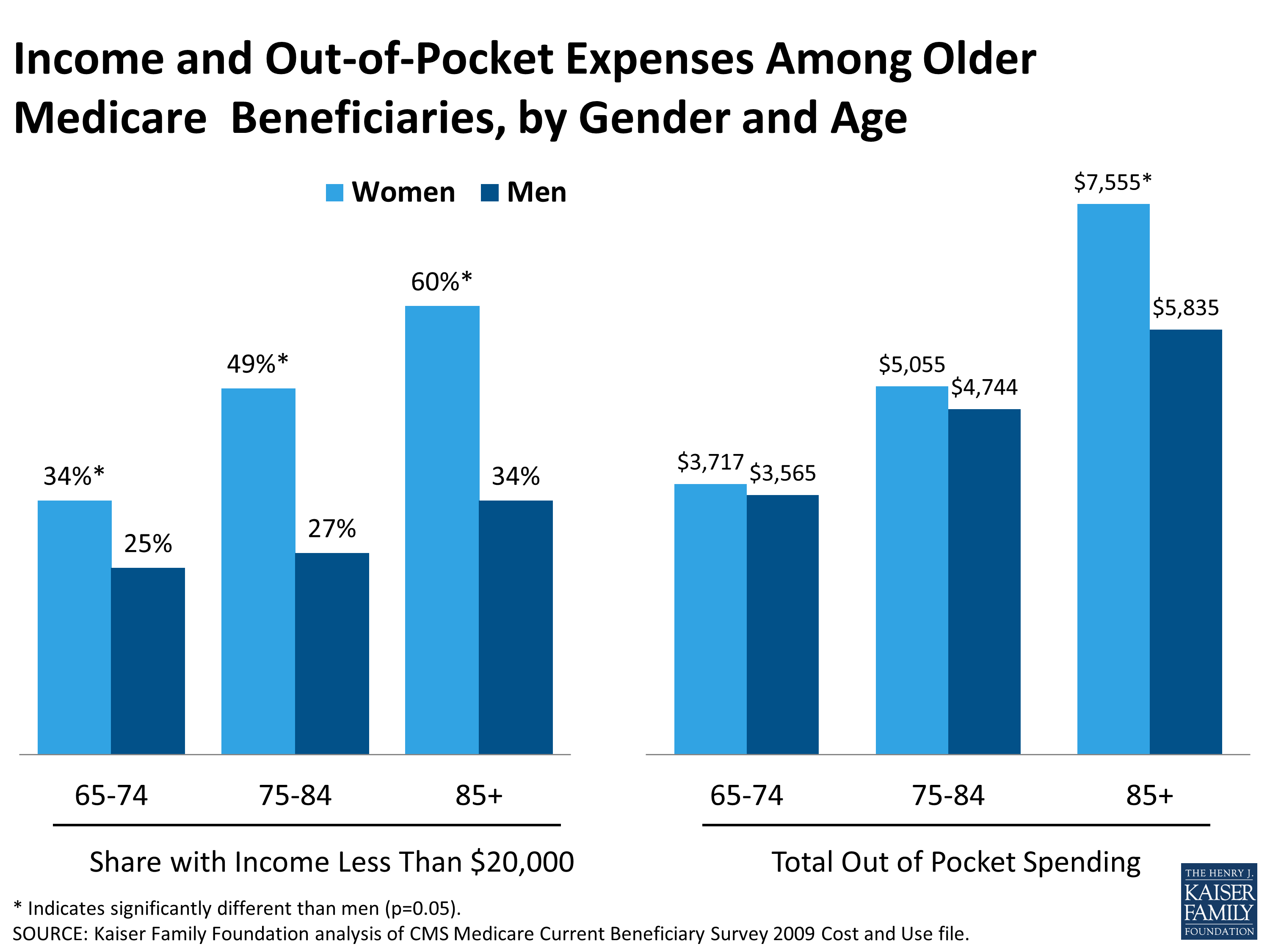

Income And Out Of Pocket Expenses Among Older Medicare Beneficiaries By Gender And Age Kff

Income And Out Of Pocket Expenses Among Older Medicare Beneficiaries By Gender And Age Kff

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.