All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Blue Cross offers open access PPO.

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

HMO Blue Select 2000 Deductible with Dental Blue Pediatric Essential Benefits.

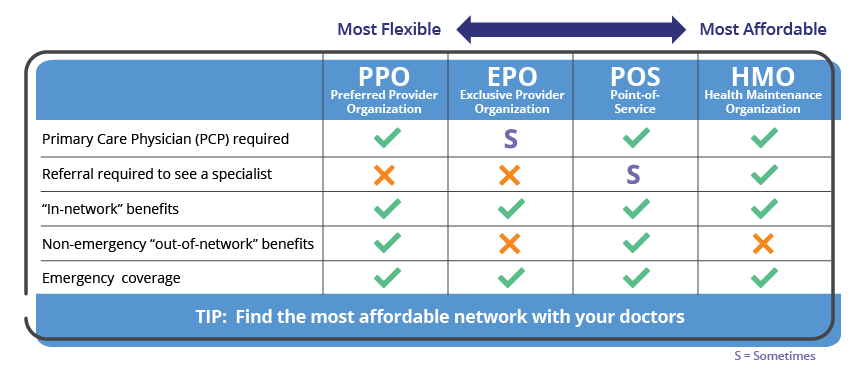

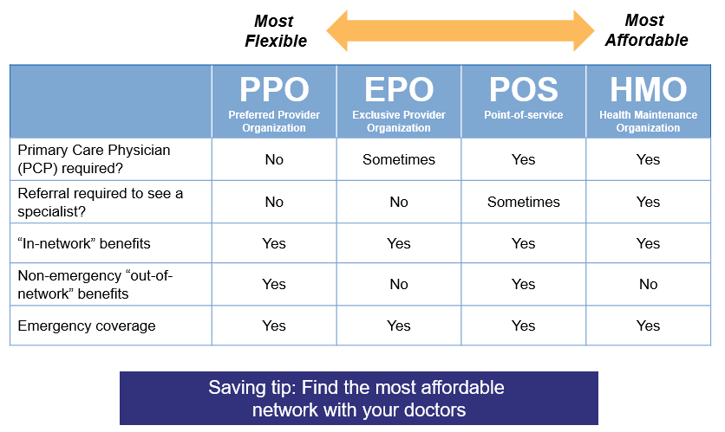

Ppo vs hmo blue cross. The most common choice youll have is between a health maintenance organization HMO plan and a preferred provider organization PPO plan. Think of it as a HMO and PPO hybrid. There are two main types of health insurance plans.

A PPO plan has a certain group of health care providers you can use when you need care. You are typically able to choose any doctor or specialist without a referral if they are in the PPO network. Both HMOs and PPOs can be open access.

Blue Cross offers associates a Health Maintenance Organization HMO medical plan option and High Deductible Health Plan HDHP Preferred Provider Organization PPO medical plan option. The difference between them is the way you interact with those networks. While HMOs have been around since the early 1900s PPO is a descendant with some new features based on challenges.

Take the PPO Vs. What are the differences between HMO and PPO plans. In this article well explain and compare the following aspects of HMO and PPO plans.

PPO Preferred Provider Organization and HMO Health Maintenance Organization. Business Health Trust partners Premera Blue Cross and Kaiser Permanente two of the most well respected insurance companies in Washington State. HMO stands for health maintenance organization.

A PPO may be a good choice for you because. Out-ofnetwork care is allowed but staying in your plans network will be far less expensive. The monthly payment for an HMO plan is lower than for a PPO.

HMO Blue Saver with Dental Blue Pediatric Essential Benefits. Choosing between an HMO or a PPO health plan doesnt have to be complicated. While a POS plan offers the flexibility of going out-of-network youll pay a greater portion of all out-of-network charges.

HMO Blue Select 1000 Deductible with Copayment with Dental Blue Pediatric Essential Benefits. You may need a personal doctor to coordinate your care like with an HMO but youll be able to go outside the network to receive care in non-emergent cases like with a PPO. But traditional HMO organizations do require that their subscribers select a single primary care doctor wholl thereafter essentially serve as their general health care coordinator-referring them to specialist health.

HMO requires you have a primary care physician and PPO allows you to visit anyone inside of a preferred network of providers doctors. Like a PPO you have the freedom to use out-of-network doctors and providers but higher out-of-pocket fees if you dont see a doctor in your plan. And both can be winners at meeting your healthcare needs.

The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment. You can get care from in-network or out-of-network providers. For a forty one year old in LA County a Silver 70 Direct HMO with Anthem Blue Cross is 283 monthly as opposed to their Silver Pathway PPO 200025 for 315.

What makes the largest difference is how your insurance plan is structured. Premeras most popular plan is a PPO while Kaiser Permanente offers both an HMO and PPO. PPO stands for.

You dont need a primary care physician PCP to coordinate your care. PPO stands for preferred provider organization. 7 Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network.

This means you can choose to see an out-of-network provider without a referral but youll pay less when you get care from a doctor in the HMO or PPO network What does Blue Cross offer. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Others view the Primary Care Physician PCP of Kaiser Permanente and the other HMOs as a gatekeeper or a prison guard who is keeping them from going straight to a specialist when they deem it necessary.

You dont need a referral to see a specialist. Both types of plans have a network of physicians hospitals and other health care professionals that agree to provide medical services at pre-negotiated prices and rates for Blues members. Its up to you to decide each year which type of plan works best for you.

HMO Blue Select 1000 Deductible with Dental Blue Pediatric Essential Benefits. HMO plan advantages and disadvantages. You pick your winner.

POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO. It Depends On What You Think of Kaiser Permanente. Really HMO vs PPO really doesnt make that much difference.

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

Http Www Bluecrossma Com Pdf Employee Options 0704 0056 Bcbsma Hmo Ppo Pdf

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Medi Share Review Why We Switched From Blue Cross

Medi Share Review Why We Switched From Blue Cross

Understanding The Difference Between In Network And Out Of Network Provider Coverage

Understanding The Difference Between In Network And Out Of Network Provider Coverage

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Integrity Urgent Care Accepts Blue Cross Blue Shield Advantage Hmo Insurance Integrity Urgent Care Blog Bryan College Station Copperas Cove

Integrity Urgent Care Accepts Blue Cross Blue Shield Advantage Hmo Insurance Integrity Urgent Care Blog Bryan College Station Copperas Cove

Did Your Blue Cross Ppo Get Discontinued

Did Your Blue Cross Ppo Get Discontinued

The Difference Between Blueselect Bluecare And Blueoptions

The Difference Between Blueselect Bluecare And Blueoptions

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.