You may only apply for voluntary life insurance through your companys specific open enrollment period so check with your employer shortly before or after. The program is voluntary because employees choose whether they want coverage or not.

What Is Voluntary Life Insurance And How Does It Work Thestreet

What Is Voluntary Life Insurance And How Does It Work Thestreet

The employer doesnt pay any of the insurance.

Voluntary term life insurance meaning. Voluntary life insurance is a type of life insurance policy that is offered through the workplace. All groups that offer voluntary life insurance also offer basic term insurance that is normally paid for by. Voluntary Permanent Life Insurance Guardian Permanent Life Insurance complements our Term Life Insurance by enabling employees to lock in pricing with a smaller policy to cover final expenses.

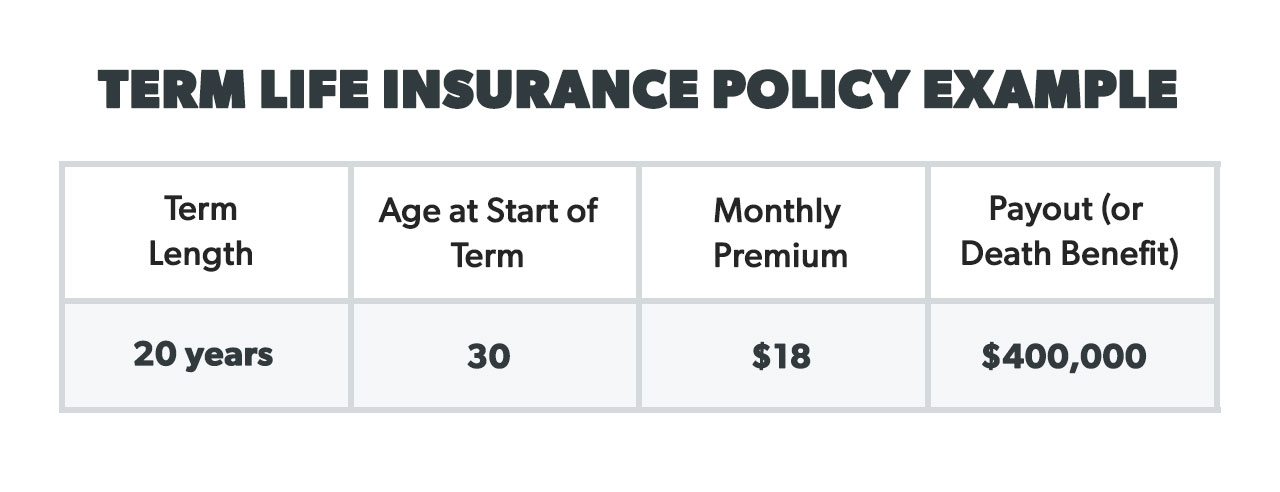

Group life insurance is usually offered through an employer as part of a compensation and benefits package. A policy can often cover just you or your spouse but typically at least one parent needs to be covered in order for children to receive coverage. If you die before the term is over the insurance company will pay the death benefit another way to say payout.

Building cash value and variable investing are. A form of term life insurance coverage that provides a return of some of the premiums paid during the policy term if the insured person outlives the duration of the term life insurance policy. Through this program an employee can buy life insurance coverage that would pay their heirs a death benefit if the employee died.

The employer doesnt pay any of the insurance cost so. We recommend buying a term policy that lasts 1520 years. Employees pay a monthly premium in exchange for coverage.

The employee is able to purchase the additional coverage at group rates. Related Terms and Acronyms. If you die after the term is over the insurance company doesnt pay.

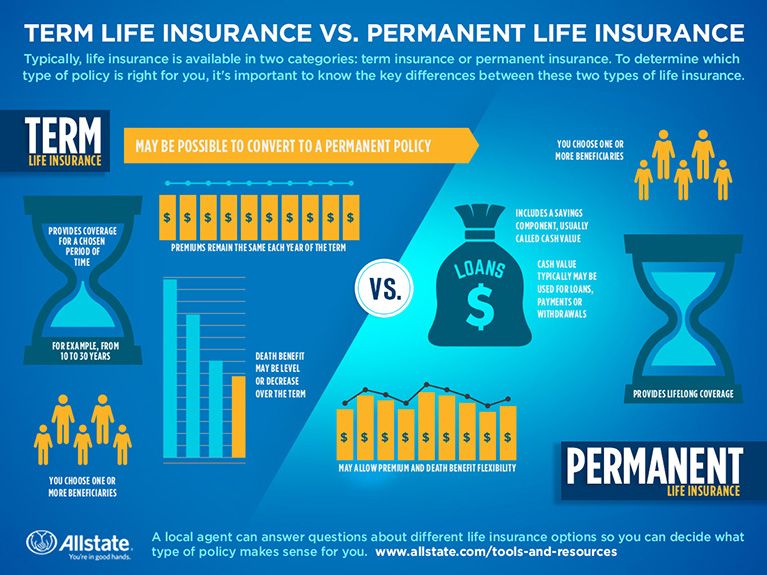

Term insurance is pure insurance this is also the case when. Voluntary life insurance is a form of term life insurance that is offered through employers. Voluntary term insurance offers coverage with no buildup of cash value inside of the policy as with permanent insurance like whole life.

Voluntary life insurance is a workplace benefit that employers can set up for their employees. Voluntary life insurance is a workplace benefit that employers can set up for their employees. Employees can also build cash value that can be used for loans or withdrawals during working and retirement years.

Voluntary group term life insurance provides coverage on an annual basis meaning each year you can choose to renew or cancel your life insurance or for a specified period of time such as 10 years. Voluntary term life insurance. The program is voluntary because employees choose whether they want coverage or not.

Premiums for a voluntary life insurance policy can be less expensive than similar individual life insurance policies due to a companys group discount. Voluntary Term Life Insurance is a provision of group life insurance where the employee may purchase additional coverage beyond what the employer provides. Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage.

This coverage ensures that if you die your designated beneficiaries will receive a cash death benefit. Voluntary term life also known as group term life insurance With voluntary whole life the insurance coverage is permanent. Group and voluntary life insurance is usually term life as opposed to permanent life insurance.

Employers offer voluntary life insurance to ensure that employees have the opportunity to purchase the amount of insurance needed at a group rate. Typically employers offer voluntary life insurance as an optional benefit. Voluntary term life insurance is a policy that offers protection for a limited period such as five 10 or 20 years.

Definition of Voluntary Life Insurance A form of life insurance offered by some employers where the employee is given the option to pay his or her own premiums. Term life insurance where benefits are provided in the case of death but in no other circumstances is a form of direct insurance and is excluded here. Voluntary term life insurance refers to the extra coverage that employees can opt-in to purchase hence the voluntary title.

In other words the insured will be covered for the rest of their life. This type of insurance also provides the insured with the option to cover his or her spouse or children and the spouse would also be covered for his or her entire life. Through this program an employee can buy life insurance coverage that would pay their heirs a death benefit if the employee died.

Term life insurance just means it lasts for a set number of years or term. Government insurance required to be purchased by certain groups and under certain conditions. Voluntary Term Life Insurance can also extend to the spouse or dependents of the employee.

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg) Voluntary Life Insurance Definition

Voluntary Life Insurance Definition

Sbi Life Insurance Policy Details Premium Benefits

Sbi Life Insurance Policy Details Premium Benefits

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/twowomenoffice-73b5904d0a2a400ba934884b623b58c7.jpg) What Is Voluntary Life Insurance

What Is Voluntary Life Insurance

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Valuepenguin

Term Life Insurance Definition

Term Life Insurance Definition

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

What Is Universal Life Insurance Ramseysolutions Com

What Is Universal Life Insurance Ramseysolutions Com

What Is Term Insurance Term Plan Meaning Max Life Insurance

What Is Term Insurance Term Plan Meaning Max Life Insurance

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

What Is Life Insurance Life Insurance Meaning Max Life Insurance

What Is Life Insurance Life Insurance Meaning Max Life Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.